Anyway by now I am a longterm investor and not a trader. I am too old to trade though I keep records.

Search

Latest topics

Disclaimer

Information posted in this forum are entirely of the respective members' personal views. The views posted on this open online forum of contributors do not constitute a recommendation buy or sell. The site nor the connected parties will be responsible for the posts posted on the forum and will take best possible action to remove any unlawful or inappropriate posts.

All rights to articles of value authored by members posted on the forum belong to the respective authors. Re-using without the consent of the authors is prohibited. Due credit with links to original source should be given when quoting content from the forum.

This is an educational portal and not one that gives recommendations. Please obtain investment advises from a Registered Investment Advisor through a stock broker

104 Technical trading experiments by HUNTER

yellow knife- Top contributor

- Posts : 6980

Join date : 2014-03-27

Anyway by now I am a longterm investor and not a trader. I am too old to trade though I keep records.

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Thank YK, for being the volunteer.

As the market is expected to take a fresh direction starting from next week, let's plan to take our first trade there.

So we need to quickly decide on the trading 'set up'.

Please contribute with your suggestion if you have.

--------------

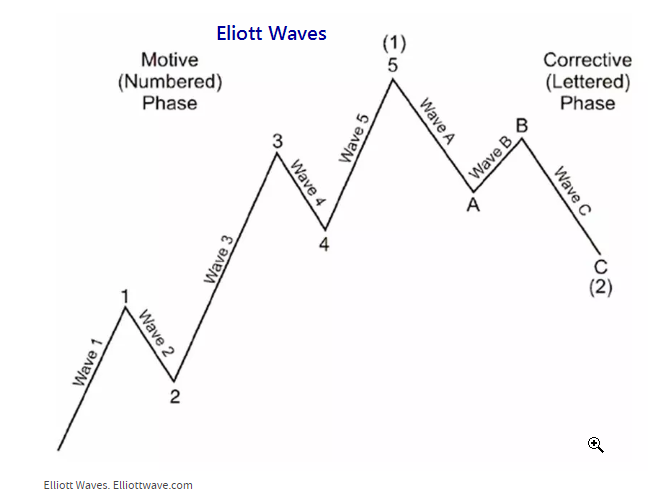

I am thinking of following a customized strategy based on; Elliott waves.

https://www.investopedia.com/terms/e/elliottwavetheory.asp

In order to validate and improve the signals given by Elliott waves, I would like to combine it with some other parameter.

(Any guesses you like to make?)

LSE- Tech Contributor

- Posts : 1321

Join date : 2014-06-04

HUNTER wrote:Wonderful!

Thank YK, for being the volunteer.

As the market is expected to take a fresh direction starting from next week, let's plan to take our first trade there.

So we need to quickly decide on the trading 'set up'.

Please contribute with your suggestion if you have.

--------------

I am thinking of following a customized strategy based on; Elliott waves.

https://www.investopedia.com/terms/e/elliottwavetheory.asp

In order to validate and improve the signals given by Elliott waves, I would like to combine it with some other parameter.

(Any guesses you like to make?)

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

I am also thinking of using Pivot points / support resistant levels to define the SL and TP targets.

In addition to that, I am thinking of a signal outside the price movement to confirm the signal.

Will talk about that in coming days.

Topcat- Posts : 117

Join date : 2019-07-25

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Topcat wrote:I have read about darvas box therory. But I dont know how to use it.. Hunter can we use it here?

Certainly, what I am thinking is, in a way, very similar. It might work very well in bullish market conditions.

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

- Post n°32

Trade Set up

Trade Set up

Primary indicator - price pattern in line with an Elliott wave expecting to compete the 5 wave pattern.

Validation of the strength of the movement - by contrasting high volume.

In summary: we will look for the initial stage of the Elliott wave formation with high volume of trades.

Illustration of an Example:

Following is the theoretical Elliott wave formation pattern.

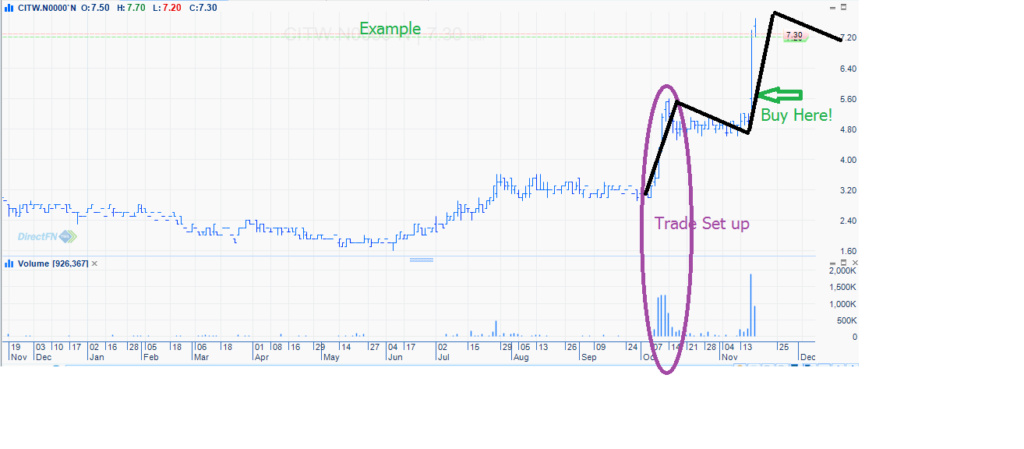

To explain this in a real world situation, I will take recent chart of AEL.N.

Following is the AEL.N one year chart.

When the Elliott wave is imposed on AEL chart, it would look something like the following.

When the momentum is confirmed by high volume, it would look like the below.

(Posted below as it seems no more pics allowed in this post)

In this set up:

Entry level is around 15/-

SL - 13/-

TP near 20/-

So the expected profit would be above 30%

Risking about 15%

--------------------

Anyone already traded this...?

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Topcat- Posts : 117

Join date : 2019-07-25

One more suggestion. Looking at this I think its better to have a trailling stop loss.. Can we do that?

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Topcat wrote:Very interesting Hunter.. So we buy at the begining of 3rd wave if volume indicator confirm it and sell after the 5th waves completed?

One more suggestion. Looking at this I think its better to have a trailling stop loss.. Can we do that?

Thanks for your interest.

* There is no hard and fast rule for buying or selling; but if you're new to trading, good to follow strict rules until you become 'instinctively' confident of your actions.

It is like....; when you drive in a highway at 100 kmph, you 'instinctively' know when to start turning in a bend, when to slow down, when to accelerate when overtaking etc.

But if you're still learning to drive, you better drive slow under strict rules.

* In my view, trailing SL is good for experienced traders; if you're a novice, have strict levels define at the beginning of the trade (don't change anything on the way).

* Yes, as you said, buy at the start of wave-3; TP at the top of Wave-5; SL at the bottom of Wave-2.

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

However, in this experiment, we will stick to pre defined strict rules.

Topcat- Posts : 117

Join date : 2019-07-25

nuwanmja- Posts : 87

Join date : 2019-02-20

Age : 33

Location : Gampaha

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

If so, let's take our first trade in coming days.

Backstage- Top contributor

- Posts : 3803

Join date : 2014-02-24

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

I see the possibility of trade set-up formation in following shares within next few days.

Do you have any preference, which one we should take this week?

1 AEL.N0000 Access Engineering PLC

2 CITW.N0000 Waskaduwa Beach Resort PLC

3 SIRA.N0000 Sierra Cables PLC

4 KZOO.N0000 Kalamazoo Systems PLC

5 CLND.N0000 Colombo Land & Development Company PLC

6 PARQ.N0000 Swisstek (Ceylon) PLC

7 GHLL.N0000 Galadari Hotels (Lanka) PLC

LSE- Tech Contributor

- Posts : 1321

Join date : 2014-06-04

HUNTER wrote:OK, let's get down to water now!

I see the possibility of trade set-up formation in following shares within next few days.

Do you have any preference, which one we should take this week?

1 AEL.N0000 Access Engineering PLC

2 CITW.N0000 Waskaduwa Beach Resort PLC

3 SIRA.N0000 Sierra Cables PLC

4 KZOO.N0000 Kalamazoo Systems PLC

5 CLND.N0000 Colombo Land & Development Company PLC

6 PARQ.N0000 Swisstek (Ceylon) PLC

7 GHLL.N0000 Galadari Hotels (Lanka) PLC

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

WRRKUMARA- Posts : 90

Join date : 2014-05-19

Ex:-

Their Portfolio Having CHL 400 000 HAYL 330,000

Onal is also it's associate company

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

LSE- Tech Contributor

- Posts : 1321

Join date : 2014-06-04

Thank you very much for your quick response. This is great. Your target is intercept with my predicted benchmark values for AEL... This is the beauty of TA...

https://forum.lankaninvestor.com/t11478p50-ael-n0000#102757

Backstage- Top contributor

- Posts : 3803

Join date : 2014-02-24

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

I'll join next week pick

Topcat- Posts : 117

Join date : 2019-07-25

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?