Again I have to strongly deviate with SLS on the terminology of long term investors.

I am a long term investor in CSE. I start buying shares in 1996 at a relatively young age and I am continuously holding my foot for last 23 years. Haycarb is my first purchase and if my memory is correct I purchased it at Rs.66/-. Not sure the price, but it was the first purchase. I learned a lesson in day one itself. Broker adviser screwed me on the 1st day itself. He advised me to purchase on the early morning which was actually the XD date. So by the days close, I was at a loss of Rs.4/- per share. I was thinking what happened and quickly realized guy screwed me. Broker was JKSB. There after I never rely on broker advisers.

Coming back to the interpretation of long term investing, it's definitely not holding continuously. You have to evaluate your investments in every three months or I would rather use the word continuously, as its more appropriate in today's world. It's changing rapidly. Business environment is changing, people are changing, products are changing, new services/products are coming in, etc. It's not the 70s, 80s, or even 90s. AGILE is golden word to remember in every morning.

Here again I will explain through a lesson. I had a considerable amount of EDEN by 2009. People thought hotels are the future and so am I. Some where in 2012 or 13 after the great crash, I was going through my portfolio. EDEN is there. I am holding it. It had touched even Rs.70/-. I haven't done any thing and again it's back close to my average price. I stop going down south on the Galle Road, I had the feeling the big gate of eden laughing at me. What a shame. There after I had few opportunities to trade on it, but do you think it will go pass Rs.70/- again under normal conditions?

What is important is evaluating your portfolio, environment and your strategies frequently and take buy/sell/hold decisions. In today's world this frequency should never go beyond three months. For me it's every week and in some cases daily.

In this forum there was a thread discussing/promoting long term investing. I read some of the posts here and there when I am on the public transport. I do not agree with most of the posts. We have to learn from our mistakes. Last few years are good examples.

Do you think Warren Buffet has not seen a Sell Note?

They buy. They sell. SLS may call this trading. I interpret it as part of investing. You have to take decisions. If any body has followed Warren Buffet, recently he had acknowledged that he cannot beat S&P any more. Why?

I can describe another example, LLUB. I was interesting in LLUB when it came to 90s. When it came to 80s bought some. Quickly realize that it's business model cannot sustain in the new environment. When it came to 60s bought again, But after seeing Dec. results I exited quickly @ 72/73, but this time at a profit. Why? Results didn't match the valuing algorithm. LLUB was struggling in facing to new realities. What if management couldn't come out of it? After looking at 1st quarter results I bought back again at more than 20% less than I sold. Is it bad?

For new comers : Study how business environment of LLUB was changed during last couple of years and how market reacted to it. What if Malaysian plant was allowed to setup? This is a classic example to learn for a long term investor, in setting up his strategy.

OK, came to write few lines. But gone well beyond.

Since this discussion is with a new comer at the center, will discuss other long term ideas and the core topic AEL in my next contribution.

So for the beginners, think about companies which are relatively young in their business cycle, if you want to hold continuously for couple of years. Love if you can point out some.

Asia-Securities-ACL-Cables-4Q-FY19-Earnings-Update-31-May-2019-1.pdf

Asia-Securities-ACL-Cables-4Q-FY19-Earnings-Update-31-May-2019-1.pdf

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

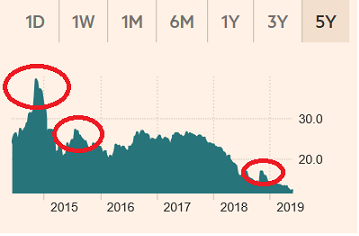

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?