Search

Latest topics

Disclaimer

Information posted in this forum are entirely of the respective members' personal views. The views posted on this open online forum of contributors do not constitute a recommendation buy or sell. The site nor the connected parties will be responsible for the posts posted on the forum and will take best possible action to remove any unlawful or inappropriate posts.

All rights to articles of value authored by members posted on the forum belong to the respective authors. Re-using without the consent of the authors is prohibited. Due credit with links to original source should be given when quoting content from the forum.

This is an educational portal and not one that gives recommendations. Please obtain investment advises from a Registered Investment Advisor through a stock broker

104 Technical trading experiments by HUNTER

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Do you think it's a good idea to make this thread public now?

We'll wait for the result of all 20 trades before engaging with the next batch of trades. If needed, we can restrict the thread again that time.

කිත්සිරි ද සිල්වා and serene like this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

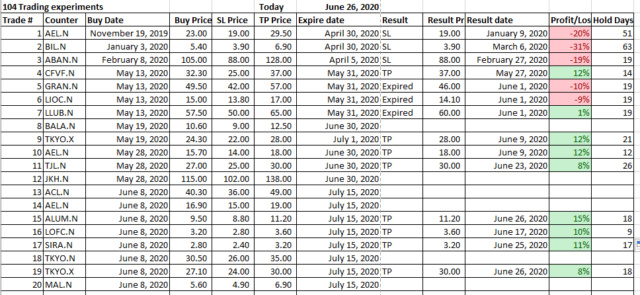

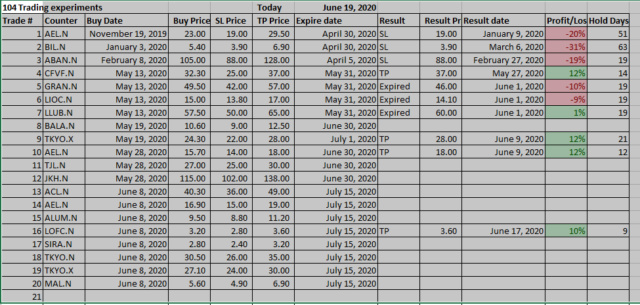

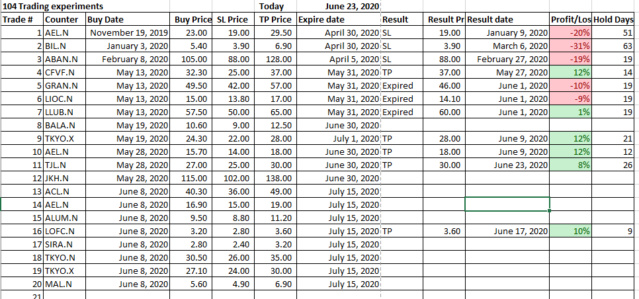

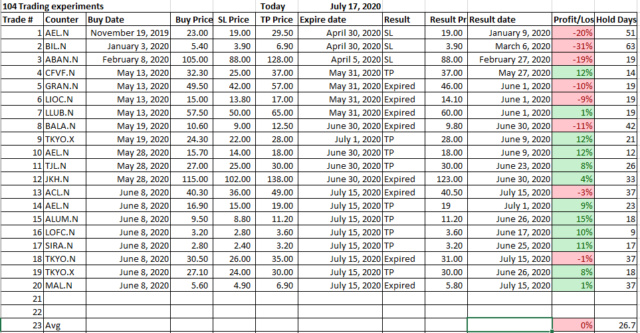

As of today, if we close all positions now, we will end up with some net profit.

We started the experiment in November 2019; ASI was 6100 at that time. Now ASI is 5100, 1000 points down.

However, during the same period, our trading results show a net gain.

Can trading outperform the market?

Last edited by HUNTER on Fri Jun 26, 2020 10:38 pm; edited 1 time in total

කිත්සිරි ද සිල්වා and nihal123 like this post

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

HUNTER wrote:Posting the results so far below.

As of today, if we close all positions now, we will end up with some net profit.

We started the experiment in November 2019; ASI was 6100 at that time. Now ASI is 5100, 100 points down.

However, during the same period, our trading results show a net gain.

Can trading outperform the market?

_________________

I am the wisest man alive, for I know one thing, and that is that I know nothing.

Socrates

HUNTER likes this post

Senarath67- Posts : 100

Join date : 2016-08-26

Well done!

කිත්සිරි ද සිල්වා and HUNTER like this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Why I wanted to start this thread was to give some first hand experience to, interested parties, on a methodical approach to trading.

I have seen many have big mis-understanding and a very negative perception about trading.

Probably, because of that, majority of forum members opposed to starting of this thread.

But few selected members including the forum Admin was positive and encouraging the effort.

Therefore, we decided to start this as a closed thread, restricting access to very limited number of members.

But, now since, with the detailed report of past 6 months, I believe most of the doubts about the intentions are cleared.

if we make this public, at least for few weeks, some members might be benefited.

What do you all think, should we make this thread open for all members for a limited time period?

In other words:

Does anyone here opposing the idea of opening this thread to all members?

Last edited by HUNTER on Fri Jun 26, 2020 10:45 pm; edited 3 times in total

කිත්සිරි ද සිල්වා likes this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

If nobody opposes, please make this thread open for all members for a period of one month.

girihell likes this post

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

HUNTER wrote:

What do you all think, should we make this thread open for all members for a limited time period?

In other words:

Does anyone here opposing the idea of opening this thread to all members?

_________________

I am the wisest man alive, for I know one thing, and that is that I know nothing.

Socrates

LSE- Tech Contributor

- Posts : 1321

Join date : 2014-06-04

Really appreciate your valuable effort on this. Great...

I always love to do research on TA since it will help for the community as well. As we develop our own approach we can make accurate signals as well.

If we can stick to an approach where we can identify more than 75% of accurate signals even in a worst situation it will be really helpful for the community. I have experienced this many times during my Pivot Point thread as well...

Please continue...

LSE

HUNTER wrote:Posting the results so far below.

As of today, if we close all positions now, we will end up with some net profit.

We started the experiment in November 2019; ASI was 6100 at that time. Now ASI is 5100, 1000 points down.

However, during the same period, our trading results show a net gain.

Can trading outperform the market?

HUNTER likes this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

LSE wrote:Dear HUNTER,

Really appreciate your valuable effort on this. Great...

I always love to do research on TA since it will help for the community as well. As we develop our own approach we can make accurate signals as well.

If we can stick to an approach where we can identify more than 75% of accurate signals even in a worst situation it will be really helpful for the community. I have experienced this many times during my Pivot Point thread as well...

Please continue...

LSE

Thanks LSE.

I have noticed an increased level of accuracy in your pivot point analysis in the recent past. I guess the market experience definitely brings it's value for the improved accuracy.

As you correctly said;

Identifying the correct signal as well as having a pre-defined trading strategy will be utmost import for long term success in the market.

LSE likes this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

කිත්සිරි ද සිල්වා and Senarath67 like this post

smallville- Top contributor

- Posts : 1872

Join date : 2014-02-23

Location : Trying to figure out..

IMO.. One issue in your attempt is that selling the qty at one go.. Where as u could opt to sell at 2 or 3 chunks with different time frames. If so the result would have not been a break-even.

Look at SIRA, u caught at 2.80 and selling at 3.20 where majority buying now.

Also when the trade is initiated for 1 month, it doesn't mean it has to be sold by a month, better to have 2 or 3 targets to maximize profits.

_________________

I take risks as a Trader and I select stocks based on Tech and daily Cash in/out. Therefore, my methods may not suit u.. so DYO analysis before making any decisions.

කිත්සිරි ද සිල්වා and HUNTER like this post

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

smallville wrote:I see some of the entry points were very good. such as CFVF @ 32.. I even bought at 33-35 in June and unloaded above 45 time to time.. Also traded recently as well buying at 47.50 and selling above 52.

IMO.. One issue in your attempt is that selling the qty at one go.. Where as u could opt to sell at 2 or 3 chunks with different time frames. If so the result would have not been a break-even.

Look at SIRA, u caught at 2.80 and selling at 3.20 where majority buying now.

Also when the trade is initiated for 1 month, it doesn't mean it has to be sold by a month, better to have 2 or 3 targets to maximize profits.

_________________

I am the wisest man alive, for I know one thing, and that is that I know nothing.

Socrates

HUNTER likes this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

smallville wrote:I see some of the entry points were very good. such as CFVF @ 32.. I even bought at 33-35 in June and unloaded above 45 time to time.. Also traded recently as well buying at 47.50 and selling above 52.

IMO.. One issue in your attempt is that selling the qty at one go.. Where as u could opt to sell at 2 or 3 chunks with different time frames. If so the result would have not been a break-even.

Look at SIRA, u caught at 2.80 and selling at 3.20 where majority buying now.

Also when the trade is initiated for 1 month, it doesn't mean it has to be sold by a month, better to have 2 or 3 targets to maximize profits.

You're spot on Small.

There are many ways of optimizing the trading performance.

That's the discussion I intend to have after the first batch of experiments.

There have been few more obvious 'mistakes' taken place, specially when exiting.

You have given a good start for the discussion; thanks a lot.

Please post if you have any other ideas.

කිත්සිරි ද සිල්වා likes this post

smallville- Top contributor

- Posts : 1872

Join date : 2014-02-23

Location : Trying to figure out..

කිත්සිරි ද සිල්වා wrote:Good strategy to follow. smallville wrote:I see some of the entry points were very good. such as CFVF @ 32.. I even bought at 33-35 in June and unloaded above 45 time to time.. Also traded recently as well buying at 47.50 and selling above 52.

smallville wrote:I see some of the entry points were very good. such as CFVF @ 32.. I even bought at 33-35 in June and unloaded above 45 time to time.. Also traded recently as well buying at 47.50 and selling above 52.

IMO.. One issue in your attempt is that selling the qty at one go.. Where as u could opt to sell at 2 or 3 chunks with different time frames. If so the result would have not been a break-even.

Look at SIRA, u caught at 2.80 and selling at 3.20 where majority buying now.

Also when the trade is initiated for 1 month, it doesn't mean it has to be sold by a month, better to have 2 or 3 targets to maximize profits.

If you remember, I was de first to tell everyone shud follow buy in chunks/sell in chunks strategy many many years back.. See its still valid for profit maximization and minimise losses if a trade goes wrong.. Its a shame I also dont follow my own strategy now-a-days and try our new things that continuously fail. LOL

_________________

I take risks as a Trader and I select stocks based on Tech and daily Cash in/out. Therefore, my methods may not suit u.. so DYO analysis before making any decisions.

කිත්සිරි ද සිල්වා likes this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Hope it is visible to all members.

We'll keep it open for one month, then make a decision on restricting again based on senior member recommendation.

During this month, we will not do any trades, but keep the thread open for any discussion.

කිත්සිරි ද සිල්වා and girihell like this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Nuinth likes this post

serene- Top contributor

- Posts : 4850

Join date : 2014-02-26

Hmmm.. Seen some activity around 54 yesterday. Buyers willing to buy.

Its not like past week or so where buyers back off when seen the quantities to sell at 54.

Still quite bit a selling also hapenning.

But still the operating environment for CFVF should be good and CFVF is one of the few good reports ecpected in JUNE.

Rajapaksap and Roshan abeydeera like this post

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

_________________

I am the wisest man alive, for I know one thing, and that is that I know nothing.

Socrates

Roshan abeydeera likes this post

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Technical indicators are mostly based on some assumptions derived from recent past behavior of price.

For example; default settings of RSI might assume that after 7 days of green days, price would move down.

Hence, if you're referring to RSI, it might indicate a sell signal after a continues rally.

If you specify the indicator considered, I may be able to give some specific input.

BTW:

As indicated elsewhere, I am not using 'Averaging' technical Indicators these days; such as MA, MACD, RSI, Bolligar bands etc.

කිත්සිරි ද සිල්වා and Nuinth like this post

Senarath67- Posts : 100

Join date : 2016-08-26

HUNTER- Top contributor

- Posts : 1935

Join date : 2014-07-14

Senarath67 wrote:HUNTER, Please see whether you could give some targets for AEL, if you observe a trend. Thanks!

Still hanging on to the previous trade; buy near 16 and sell below 20.

If the price establish above 20, will consider a new trade.

Senarath67- Posts : 100

Join date : 2016-08-26

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?