by xmart Thu Oct 25, 2018 9:56 pm

by xmart Thu Oct 25, 2018 9:56 pm

REXP

There is an interesting chart again. REXP has been on the downward channel since 2016 and indicators show that turnover occurred at 160 level. a breaking of 200 psychological barrier would ensure that down trend has also come to an end.

the breaking of 200 would open possibilities to test the immediate resistance of 220, then 245 and 265 in the coming months if the trend is strong. fundamentally if REXP could earn 50+ EPS with favorable exchange fluctuation, GSP+ etc.

BFL

Technically, BFL is forming a double bottom in the weekly chart around strong support area 115. given policy decision on maize importation, it is not possible to expect big appreciation in share price but forming of the double bottom would take BFL to 155-160 region for consolidation.

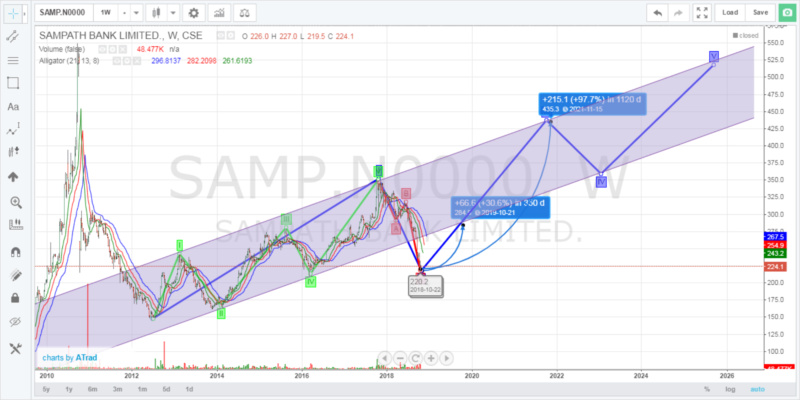

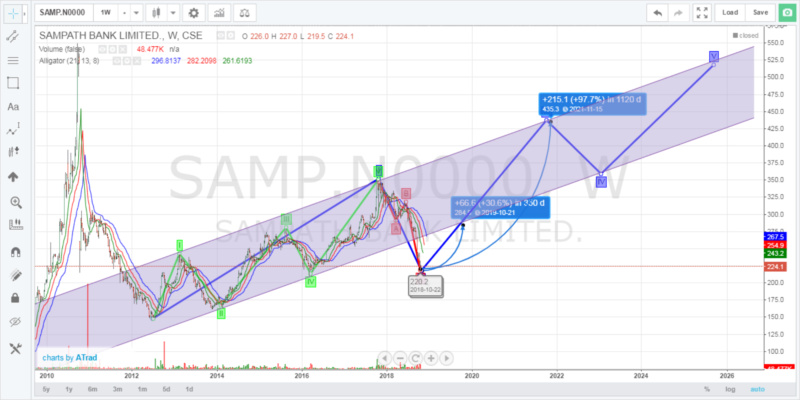

SAMP

classic chart for classic share. SAMP has completed it's 5 waves in complete Elliot cycles from 2012-2018 period in another major Elliot wave (Wave I) and then looking forward to start its 2nd wave to 450+ in 4-5 years. but excessive correction had brought the share below to 220 which is discounted since technically bottom could have been around 250.

deeper the correction, swifter the wave! so, this share probably corrected to 275-280 level once the market base established.

SCAP

interesting chart for failing wedge bullish continuation. testing of psychological barrier 6 in coming days is an inevitable and likely breaking of 6 to test 6.3 would bring 20% capital return and nearly 8-10% dividend gain. if 6.3 resistance broke successfully with the failing wedge, we could expect SCAP to test 7.50 -7.70 in coming months.

open for discussion! please..

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?