Over to you.

Search

Latest topics

Disclaimer

Information posted in this forum are entirely of the respective members' personal views. The views posted on this open online forum of contributors do not constitute a recommendation buy or sell. The site nor the connected parties will be responsible for the posts posted on the forum and will take best possible action to remove any unlawful or inappropriate posts.

All rights to articles of value authored by members posted on the forum belong to the respective authors. Re-using without the consent of the authors is prohibited. Due credit with links to original source should be given when quoting content from the forum.

This is an educational portal and not one that gives recommendations. Please obtain investment advises from a Registered Investment Advisor through a stock broker

Should CSE be like this? Whose FAULT is it?

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

Over to you.

Yin-Yang- Posts : 1321

Join date : 2016-03-12

yellow knife wrote:Ying-Yang

yes... this is the expectation

Now justify that with 2011 and 2012 of Sri Lanka.

Bro,

I thought you were a long term player.

Take at least 10 year span.

You cannot judge the size of the elephant by catching just a hair of its tail,

yellow knife- Top contributor

- Posts : 6980

Join date : 2014-03-27

now the discussion is on right track.

yes , longterm players are happy with this kind of opportunities .

Even good long term players like Merryl J would find these opportunities and take actions.

The argument you was developing is valid.

GDP affects market.

Yes... but not always... There are many other factors. That is why I took 2011 and 12 where there was reversing of the expected direction.

Yin-Yang- Posts : 1321

Join date : 2016-03-12

yellow knife wrote:

+

+. There are many other factors.

+

.

Oh Yes.

Global Oil prices should be in some corner of you other factors list I am sure mate.

yellow knife- Top contributor

- Posts : 6980

Join date : 2014-03-27

yellow knife- Top contributor

- Posts : 6980

Join date : 2014-03-27

yellow knife- Top contributor

- Posts : 6980

Join date : 2014-03-27

yellow knife- Top contributor

- Posts : 6980

Join date : 2014-03-27

Yes,,, no doubts many factors like crude oil, gold, interest, GDP show positive or negative relationships.

Yet when market is in Bull Phase some try to promote it further and further up.

When market enter in to Bear Phase some try to demote it further and further down.

***********************************

CSE has become attractive.

When its attractive there are no efforts to show how its worthy to buy now.

Ethical Trader- Top contributor

- Posts : 5568

Join date : 2014-02-28

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

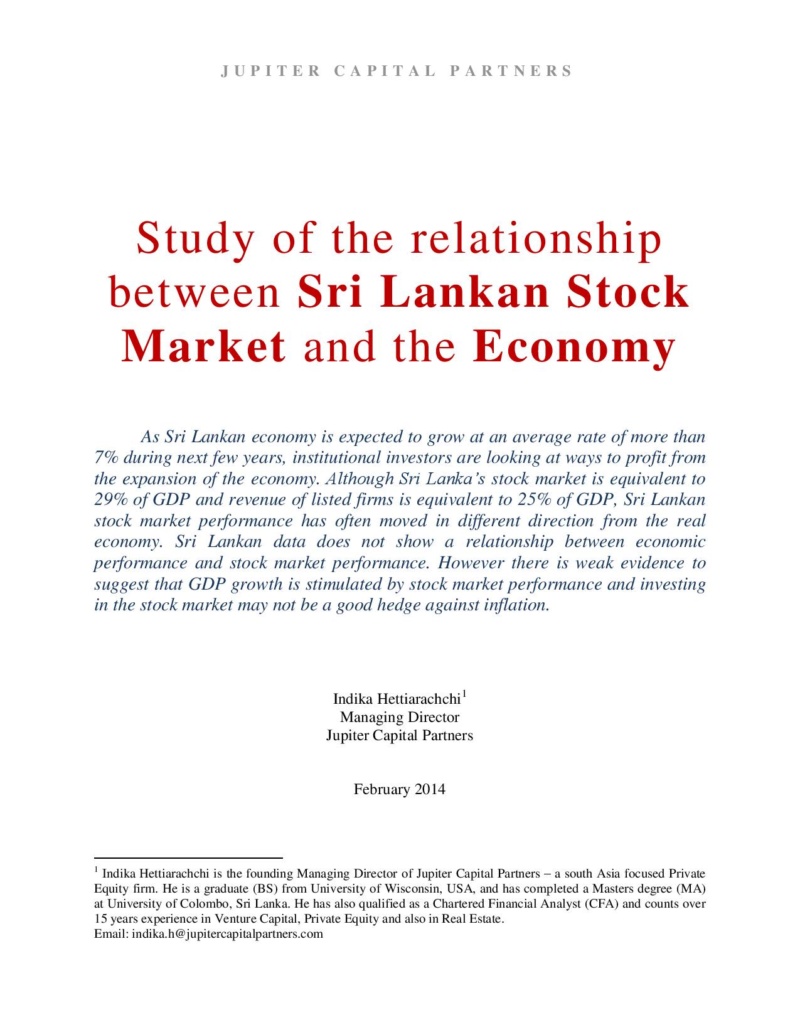

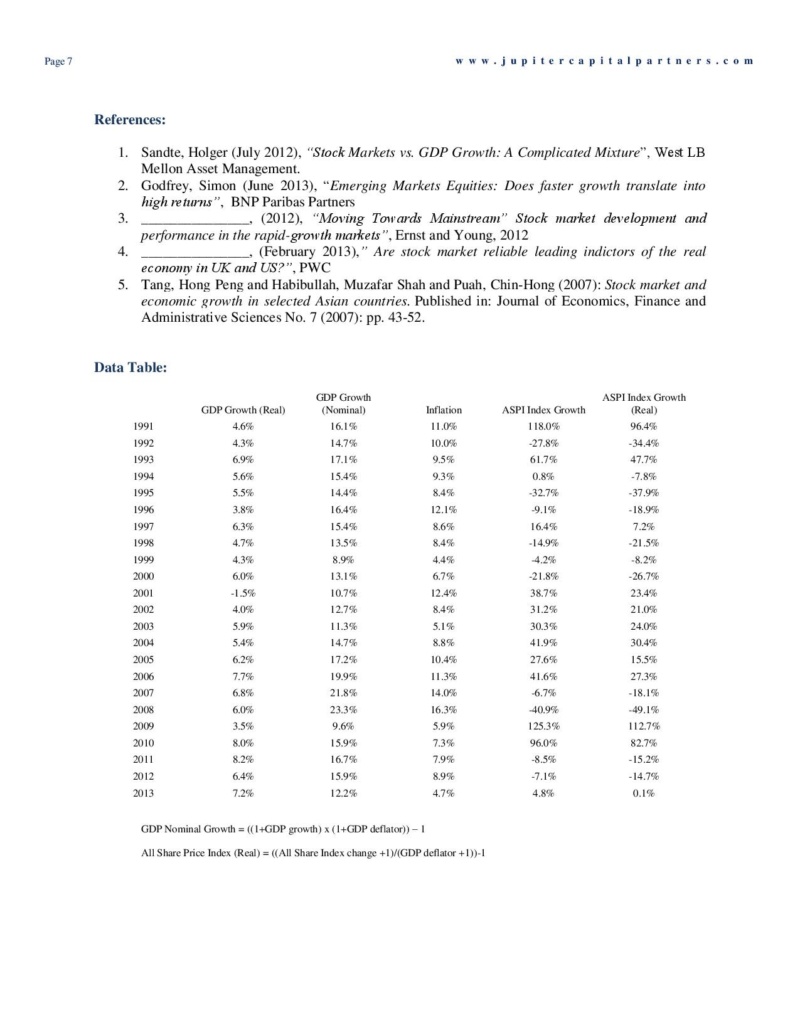

There was a claim that the reason CSE was going down was due to lower economic growth. Below I include a rather professional report/study done by Jupiter Capital Partners on the same topic. Last page (naturally) has their conclusion whether GDP does or does not affect CSE much and if not why.

~~~~~~~~~~~~~~~~~~~~

Ethical Trader- Top contributor

- Posts : 5568

Join date : 2014-02-28

pjrngroup- Posts : 444

Join date : 2015-11-01

Yin-Yang- Posts : 1321

Join date : 2016-03-12

So the Ultimate conclusion of Indika Bro is; "+++stocks may

not be a good way to preserve wealth

in the longer term"Aha!!

Yin-Yang- Posts : 1321

Join date : 2016-03-12

The article suggest only fools will invest in CSE but opportunistic traders might gain something.

Kith Uncle!

It says you are only fooled by yr gut feeling!!

කිත්සිරි ද සිල්වා- Top contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

Let's see who will have the Last Laugh Jiggy

Yin-Yang wrote:

Kith Uncle!

It says you are only fooled by yr gut feeling!!

By the way, who is this trigger-happy Ass here?

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

කිත්සිරි ද සිල්වා wrote:Ha Ha Ha, hitherto it has not failed me and being a doubting Thomas all my life, not only I doubt such predictions and their so-called Academic credentials too."

What predictions are you referring to ?

Jupiter Capital articles main focus is on studying GDP vs ASI and whether it

has any effect on CSE based on data.

That why posted it for educational purposes as there was a claim

CSE went down due to GDP growth being down.

YY, has picked one sentence from the article ( which I don't also know why JCP had to throw in there) and is commenting on such.

But main focus should remains on GDP vs ASI.

Last edited by slstock on Tue Jul 24, 2018 12:43 pm; edited 1 time in total

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

A present STATUS Update CSE (on possible ASI ) is made below.

https://forum.lankaninvestor.com/t983p1025-cse-l-where-are-we-heading#89532

I know many like to know about market direction ( to consider to hold or sell shares in short term)

So the update above is made objectively comparing/updating the technical status mentioned on July 13th.

The Alchemist- Top contributor

- Posts : 651

Join date : 2014-02-25

“We thought the world was going to end in 1997,” recalls Head of Investments at Softlogic Holdings Niloo Jayatilake, then a rookie fund manager. That year, capital fleeing the East Asian economic crisis wiped out half of the Colombo Stock Exchange’s value.

“Around that time, a senior fund manager told me, ‘buy when foreigners sell, and sell when foreigners buy’,” Jayatilake says. It was an important lesson to the young fund manager. Don’t be swayed by sentiment. Accept market cycles. Embrace downturns. The last five years have been good to global equity markets, but not in Sri Lanka.

The MSCI Frontier Markets Index gained 32.32% in 2017. MSCI’s emerging markets index grew nearly 24%. Sri Lanka’s All Share Index gained 3% that year, declining more than 2% during the first six months of 2018. But Jayatilake sees opportunity.

Sri Lankan equities are trading at a 12-month trailing price to the earnings multiple, also called the price-to-earnings (PE) ratio, of 10 times. This means investors are willing to pay Rs10 for each rupee in earnings a company makes. This valuation is less than the 10-year average of 14.9 times. For Jayatilake, low valuations are a good sign.

In 2009, the market was trading at an earnings multiple of 16.6 times, and a higher 25.2 times the following year.

“Today’s equity market PE is at the lowest point, so why are we acting like it’s the end of the world? If we’re not investing now, we’re wasting an opportunity,” she says.

1“It is a good time to invest for the long term if you can back your decisions with proper research into the companies. It may not be a good short-term strategy, but these are ideal conditions for longer-term gains.”

“The power to hold is key to success in this business. High-net-worth individuals are amazing because they have held on to key blocks of shares through all the cycles and built their wealth this way,” Jayatilake says. “In most cases, they’ve been more successful than institutional investors who have the money and staying power, but not the discipline.”

After the 1997 East Asia crisis, it took nearly five years for the Sri Lanka equities market to recover, crossing 1,000 points in June 2003. “That was not the first time the world ended,” Jayatilake says, “It ended again in 2008.

“That year, the global financial crisis that unfolded in 2007 cut the value of Sri Lankan stocks by half. In 2012, equities lost more than 40% in value when regulators began looking into market manipulation after the benchmark index reached a month-end peak of 7,800 points in 2011.It took three more years for the index to again breach the 7,000 mark in 2015, but has since declined 11.2% to 6,218 points by mid-June 2018.

“I’ve seen much worse,” Jayatilake says, laughing. “The economy is not in disarray as sentiment suggests; it’s just that people don’t believe anymore,” she says. “However, I am excited about the current period. As a professional fund manager, I embrace these kinds of situations to build the portfolio.”

According to published figures, Softlogic Life Insurance has a life fund of Rs10 billion with 20% in equities—under the 40% maximum limit allowed by regulation—a decent allocation for any investor. In 2017, the entire insurance industry portfolio had less than 10% in stocks.

Ethical Trader- Top contributor

- Posts : 5568

Join date : 2014-02-28

Yin-Yang- Posts : 1321

Join date : 2016-03-12

කිත්සිරි ද සිල්වා wrote:

+

+

+

+ Jiggy

+

+

+

Ayyo Big Bro.

Let Jiggy Bro be Jiggy

Let me be me.

If you really insist, you may call me Jig-Jagg

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

Yin-Yang wrote:කිත්සිරි ද සිල්වා wrote:

+

+

+

+ Jiggy

+

+

+

Ayyo Big Bro.

Let Jiggy Bro be Jiggy

Let me be me.

If you really insist, you may call me Jig-Jagg

While you"ll are at it, for out of topic weekend fun, here are a few more names to consider

a) Jiggy Yang ( sounds like a horny Chinese)

b) Jiggying with Yin ( a very horny Chinese)

c) Yin Saurus ( a "recently discovered" chinese Dinosaur)

d) Jagged Yin ( you know what it sound like)

e) Jigme Yang ( seems to be related to Bhutan Royalty - Jigme Singye Wangchuck )

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

Foreign Selling/Buying

For those who are worried about Foreign selling

1) So far to date in this year :

Foreign Selling is only Rs 2.52 Bil.

( That about US$16 million. Some billionaires will laugh at that amount am sure)

Quiz : How much was the Foreign selling in 2011?

2) For past week :

Net Foreign Inflow/Buying : Rs 23 million

Last edited by slstock on Sat Jul 28, 2018 10:20 am; edited 1 time in total

Ethical Trader- Top contributor

- Posts : 5568

Join date : 2014-02-28

serene- Top contributor

- Posts : 4850

Join date : 2014-02-26

slstock wrote:

Foreign Selling/Buying

For those who are worried about Foreign selling

1) So far to date in this year :

Foreign Selling is only Rs 2.52 Bil.

( That about US$16 million. Some billionaires will laugh at that amount am sure)

Quiz : How much was the Foreign selling in 2011?

2) For past week :

Net Foreign Inflow/Buying : Rs 23 million

Rs.(19,039.2) Millions

serene- Top contributor

- Posts : 4850

Join date : 2014-02-26

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?