how you guys going to recover this share investment?

share your views on this company please. will it rise up again??

Information posted in this forum are entirely of the respective members' personal views. The views posted on this open online forum of contributors do not constitute a recommendation buy or sell. The site nor the connected parties will be responsible for the posts posted on the forum and will take best possible action to remove any unlawful or inappropriate posts.

All rights to articles of value authored by members posted on the forum belong to the respective authors. Re-using without the consent of the authors is prohibited. Due credit with links to original source should be given when quoting content from the forum.

This is an educational portal and not one that gives recommendations. Please obtain investment advises from a Registered Investment Advisor through a stock broker

pathfinder and NIRMALSG like this post

Rational Investor likes this post

Re: BLI Investors please who bought shares in 2015 @ 150/-

Yesterday at 11:21 pm

so BLI at any chance it wont rise up again to 150 levels isnt it?

i bought it at 150/- levels around 1000 shares

on Tue Oct 13, 2015 7:18 am

Agree with you Small

Apples should be compared with apples and not with olives.

However I just took PLC to show that BLI is over valued

eagle wrote:so BLI at any chance it wont rise up again to 150 levels isnt it?

i bought it at 150/- levels around 1000 shares

eagle wrote:so BLI at any chance it wont rise up again to 150 levels isnt it?

i bought it at 150/- levels around 1000 shares

slstock wrote: XXXXX ( I deleted to protect the identity of that person)

I am happy if you are in profit.

But do me a favor and not promote BLI to give any idea this is a good investment ( to new people) anymore.

Can it go up higher until someone desides to dump.

Current price is manipulated to 2011 level and is not worth half as much

on present fundamentals

slstock wrote:Are you the LION I knew from 2 year ago?

Look my friend, the objectives of this forum is different.

Unless you justify the below comment, this will be take as a promotion.

So I don't want you to get branded as promoter. So am saying this.

By what mean is this worth and should go up like BLI ?

Explain yourself. Do not take last quarter eps itself.

One quarter their whole earning came from impairment reversal.

Any share can be manipulated and if the entry and exist is figured one can do trading. So I will not rule out the possibility this can go up or be traded.

Are you saying this is worth over Rs 100 like BLI

But be careful of what you say as there are New Comers here whom we do not want to think GSF is fundamentally strong investment that should go up like BLI.

FYI BLI is in sheer manipulation stage at present price and not worth even 50% of current price by value. It can stay high as long as

nobody sells but when it start coming down one might have to find a road to run.

I remember a sahre that traded at Rs 1500 coming down to Rs 20

slstock wrote:slstock wrote:

VFIN :

I estimate VFIN to report about Rs3.5 - Rs 4 eps for March.

Dividend about Rs 3.

Let see how close we can get.

No matter who says what VFiN theoraticallly to me is valued more than

COCR, HDFC and BLI. One can argue one can push .. but if one remembers the comment I made when COCR was Rs 60-70 and VFIN was trading below that , all i can say now is COCR is Rs 50 now and VFIN is Rs 67

Ref :

https://forum.lankaninvestor.com/t5227p225-lfin-future#68066

slstock wrote:

Some thought COCR Was god the way they grew initially.

When we warned about the issues they can have some people must have thought we are jealous or crazy of them holding the super Rs 70 share.

Same can be said about BLI growth.

slstock wrote:

On the hand, I saw some ( in cyberspace) thinking too deep on BLI to make it wonder company now.

Seems COCR craze has died these days.

yellow knife and eagle like this post

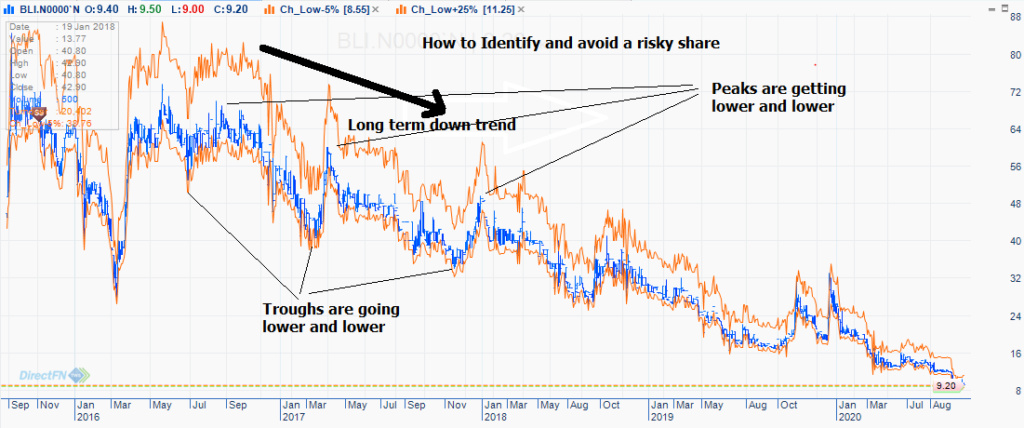

HUNTER wrote:More often than not, anyone can easily identify Risky shares, very early, by just looking at the price levels over few months.

Simply, pay attention to the direction of general price levels, peaks and troughs.

This patterns is almost always identical with risky share.

I am posting below the visuals of BLI.

Furthermore:

It wouldn't take more than 10 seconds to identify a 'bad' or good share.

(That's the beauty of TA; TA can do things in seconds where FA might take Days or Weeks)

eagle wrote:thank you SLSTOCK for your comments & your valuable time spent on this thread!

i was new to the stock market that time & i blindly bought the shares. got trapped to promoters obviously. now i have no idea how im going to recover this money

just a hope for a miracle to happen..

however karma will bounce back to the promoters of BLI for surecoz its all my hard earned money!!!

yellow knife, Rajapaksap and slstock like this post

Rajapaksap wrote:Dear slstock,

You have the facts, knowledge, guts, and energy to tell the truth. You are so much kind to spend your time, for others. Your analysis and advice are very useful to all of us.

I am very grateful to you and, I keep hopes to hear your comments frequently.

eagle likes this post

slstock wrote:Hunter,

I do not mean any offense to you or techincals.

Since I showed up to assist Eagle and I saw your post , there is something

I see you forgot to mention which is crucial.

I tried but I can't go away with a clear conscience not mentioning it.

Sorry. So I came back to make this post.

When a share price is continuously running upwards beating past highs,

technicals are not ideal to follow. AT THAT TIME, the charts/indicators can show the share is bullish as it keep attaining new highs. What the next target

if its at a new high.

So people can blindly follow expecting higher and higher prices.

More importantly most indicators are lagging ( including the lines , patterns

you drew and showed). So people find their mistake or can refer to charts only after the share dropped a lot to say it is a "bad share". What about at Rs 150?

Best solution would be to understand a Share Value

( fundamental analysis) and maybe combine with techincals to enter and exit.

CIND recently hit it all time high at Rs 65. Charts can show bullish signals.

But I made a post on Facebook to say, CIND to me has presently attained its

right fundamental value so not to expect much higher prices

( unless ASI keep going up) until next report shows enough earning

justification.

ps:

For anyone who does not know what lagging means !

Lagging indicator means it can be only seen after some event has happened.

Ex : BLI can be trading at Rs 150 with bullish sentiment ( like when eagle bought it). But only after weeks, months , after BLI drastically dropping in price in a negative tangent we can only see the chart is showing such ( os its lagging)

But at Rs 150 and all time high ?HUNTER wrote:More often than not, anyone can easily identify Risky shares, very early, by just looking at the price levels over few months.

Simply, pay attention to the direction of general price levels, peaks and troughs.

This patterns is almost always identical with risky share.

I am posting below the visuals of BLI.

Furthermore:

It wouldn't take more than 10 seconds to identify a 'bad' or good share.

(That's the beauty of TA; TA can do things in seconds where FA might take Days or Weeks)

| කිත්සිරි ද සිල්වා (9679) | ||||

| yellow knife (6980) | ||||

| nihal123 (6327) | ||||

| slstock (6216) | ||||

| sashimaal (5785) | ||||

| Ethical Trader (5568) | ||||

| serene (4850) | ||||

| Backstage (3803) | ||||

| Sriranga (3226) | ||||

| The Invisible (3116) |

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?