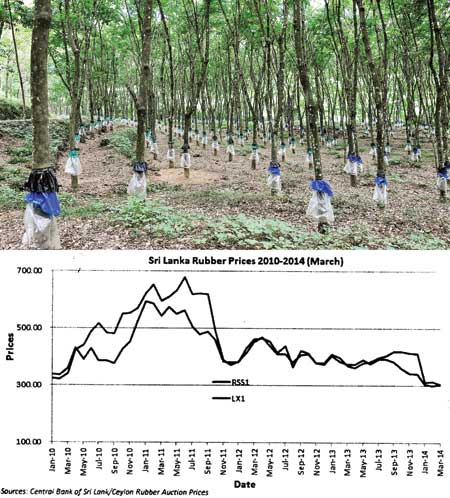

Despite rubber being one of our key productive assets there is growing concern of the continual price declines experienced since 2012. Although enjoying a boom for nearly a decade, Sri Lanka’s rubber prices have seen considerable declines in recent times.

Colombo Rubber Traders’ Association (CRTA) Chairman, M.S. Rahim said "The price drop in the world reflected on us too. With lower prices in the current period costs of production will increase and we’ll be faced with losses. Smallholders too have to bear the price drop and drop in production due to bad weather conditions that prevailed in 2013."

Commenting on the prices declines he added "In 2010 prices (Thick latex crepe) reached a high of Rs. 593. In 2011 prices reached record highs of over Rs.600/- for a period of seven months. After a slow start in 2012 prices recovered thereafter but began to drop slowly to end the year at Rs.385/- per kilo."

"In 2013 the market recovered quickly at the beginning of the year to reach over Rs.400/- in the first quarter after which there was slight drop in the second half but overall prices were stable at Rs.400/- till the end of the year. From January 2014 there has been a sudden sharp drop in latex crepe prices to a current Rs.305/-," Rahim stated.

The recent Weekly (1st April 2014) Rubber Auction recorded average prices for Latex Crepe between Rs.300-230 and RSS remained unquoted. Deputy Chairman Planters’ Association of Ceylon (PA) and CRTA Vice Chairman S. S. Poholiyadde said "Over the last three years, the rubber price has fallen by over 50%. It is now around Rs.300, where it was Rs.600 in 2011."

Price Declines

Explaining the reasons for this declines Poholiyadde said "This is mainly due to the global economic situation. Especially in European countries, there has been an economic slowdown. This has had an impact on the prices globally."

Adding to the gloom in rubber’s bear market is the supply glut as stockpiles in China swell. "There has been stockpiling in China. Most of the largest manufacturing facilities are in India and China, and this too has pushed their market up compared to us," Poholiyadde noted.

Commenting on the easing demand from the world’s largest consumer of the commodity, Damitha Perera, Director Rubber, Forbes and Walkers Commodity Brokers stated "The price is stagnant now. The reason is stockpiles in China with 300,000 tonnes. They are not aggressive in the market, and it’s not good for us."

"Crepe and RSS is stagnant as this is the lean period and off season. A boom in prices is not expected for a few months." Perera added.

Production Challenges

The cost of production remains a key challenge affecting the performance of the country’s rubber industry. Compared to earlier years the cost of production (COP) continues to escalate and is expected to increase further.

"China the largest consumer in the past four years found their economy slowing down and, due the fact that they were over stocked, prices had to slow down. Besides countries such as Vietnam and all other producing countries had reached high levels of Production" Rahim noted.

The Plantation Workers’ Collective Agreement of April 2013 has exacerbated this. "There has been an increase in the cost of production by about Rs.20-25 as a result of the wage increase said Poholiyadde. "Wages will obviously further increase. We need to adopt strategies to lower cost of production," said Professor Asoka Nugawela, Professor of Plantation Management at Wayamba University.

Smallholder and RPC Impact

A vital sector of the rubber industry is the smallholder who grows 60% of the rubber produced in the country. "When production comes down, it is the smallholders who are mainly affected," says Poholiyadde. Because of low yields, smallholders will be compelled to sell their produce at depressed prices.

Smallholders, who receive insufficient revenue because of low yields and low prices, could be forced to convert land to other crops. The CRTA Report 2012/2013 states "It is critical that these smallholder growers obtain the best possible prices for their rubber, in line with prices realized at the auction, to enable them to remain viable."

Declining prices also affect the larger Regional Plantation Companies (RPCs). Not only are smallholders feeling the pinch, but the large RPCs are affected too. According to Professor Nugawela, "A drop in the farm gate price of more than Rs.100/kg will have a significant negative bearing on producers in both sectors."

Environmental and Land Issues

For competitiveness and viability of the industry, key issues such as environmental and agriculture issues need to be addressed. Experiencing extreme weather patterns also contribute towards a decline in production

"The limited land area we have for rubber and land acquisitions are causes for concern" says Poholiyadde, "in addition to tapper shortages, especially with the younger generation not wanting to get into this line of employment."

With these difficulties affecting the industry, Professor Nugawela requests a vision for the foreseeable future, "We have to manage with a vision to achieve a substantial growth in productivity and performance to challenge the inevitable increases in COP."

Future Survival

With production and price declines affecting the industry, public sector support becomes imperative. According to Poholiyadde a protectionist strategy is crucial "I would say it’s very vital, because over 60% of this industry production is by smallholders. So many people are dependent on rubber for survival."

Commenting on the way forward Poholiyadde says "We should ensure that value-addition factories continue to work uninterrupted. A lot of people have their hope in the rubber industry."

Sri Lanka’s rubber industry needs to attract foreign investment in order to expand and diversify, "We should promote more such industries to come in and set up manufacturing facilities here. I believe that is the way forward" he added.

http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=101871

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?