there are a lot of promises with the port city and related development will there be increased demand and resultantly increased capital appreciation? or this real estate boom is just another bubble where most of the retail investors end up with lifetime loans?

Search

Latest topics

Disclaimer

Information posted in this forum are entirely of the respective members' personal views. The views posted on this open online forum of contributors do not constitute a recommendation buy or sell. The site nor the connected parties will be responsible for the posts posted on the forum and will take best possible action to remove any unlawful or inappropriate posts.

All rights to articles of value authored by members posted on the forum belong to the respective authors. Re-using without the consent of the authors is prohibited. Due credit with links to original source should be given when quoting content from the forum.

This is an educational portal and not one that gives recommendations. Please obtain investment advises from a Registered Investment Advisor through a stock broker

Real Estate Market in Sri Lanka- A booming Industry or a Bubble?

xmart- Top contributor

- Posts : 732

Join date : 2015-01-17

there are a lot of promises with the port city and related development will there be increased demand and resultantly increased capital appreciation? or this real estate boom is just another bubble where most of the retail investors end up with lifetime loans?

puliyanam- Top contributor

- Posts : 482

Join date : 2014-02-28

The supply of new premises in residential market has increased tremendously over last decade or so, especially with the increase in the apartment supply in the Colombo district. It has caught up in some other district too, though not as severely.

THe supply of new premises in commercial property market is now on the increase with city center and the like with the planned port city etc shifting gears on the definition of "up-market" property.

According to CBSL, the prices of land increase by 16% or so from 2017 June to 2018 June in Colombo district.

So what is happening is supply is increasing in terms of units, land prices are increasing and a huge construction effort is onging, predominantly in the colombo district. But other districts are gradually getting there.

So what? Occupancy (Yield and shift)

Well this trend could get derailed as follows

People who bought these for investment purposes or developers who developed without fully pre-selling are already witnessing some issues. THis could translated to lower yields going forward. Or know on impact on tourism sector. THat is what some times reffered to as bubble by CBSL (based on NPA's reported by banks by sector perhaps)

Shift to high end flashy properties from the current property which are old could start a price war, in commercial sector leading to me-too properties struggling with lower economic growth witnessed in many sectors.

Will it happen? When?

Honestly i dont know

Residential

Low end: Low occupancy or shift doesnt seem an issue so ok in my view

Mid market: definitely an issue

High end: Issue is visible

Very high end (>450 USD/Sq.feet): hmm not sure. May be an issue.

Commercial: Definitely an issue

Will i invest in the sector?

Personally im a land person not appartment person. Land stock cannot be increased, not by much even if you take reclamation into account . And fixed supplies are good for prices, at least in the long run!

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

I want to add something on Foriegners moving to SL or buying/renting property which may not be apparent or discussed by media.

Actually Sri Lanka is getting quite unattractive for foreigner to buy/rent property and settle down ( even to visit but that is another matter)

Here are some reasons

1) Unless in rural areas , Condo / Property buy/rent prices in main cities ( specially in Colombo / Kandy ) is actually quite expensive. Same can be had in Thailand ( and even Vietnam) for A fraction where infrastructure facilities, health case, cost of living is much better.

2) Most food items foreigners are used to in their homelands are not freely available in SL. If they can be found , they are amazingly expensive due to high import taxes.

Look how expensive Cheese is. ( Seriously I don't think cheese is a luxury. It is not Caviar!) I heard even a small bag of M&M candy is over Rs 1000 in Sri Lanka now.

It usually less than half price elsewhere in the world. How much are Grapes and Oranges ? Are these luxuries ? ( Are Grapes or eating Oranges ( Orange Orange) grown in SL enough to substitute with local products? )

3) Red tape and other tape is absurd in Sri Lanka.

Ex 1 : Some years ago , I knew an educated lady ( counselor) from England trying to settle down in SL. She once told me she was going through hell to get her resident visa renewed due to red tape in SL. Look she was rich, educated , helping local people and owned property here, yet SL policies were so complex she might have had to sell everything and return to UK.

We are not UK or USA to get rid of such people. We attract few to start with and then ... ?

Ex 2 : I was once at the Local Customs office to clear some books. There was an Australian who was sitting there for ever and quite upset with something. Finally he left very unhappy.

Later I quietly talked to the Custom officer to find out what happened. The Aussie had got shipped 3 bottles of tonic ( for one of his medical needs) to SL.

Customs wanted to Charge him Rs 15000 to clear it.

Actually the bottles costed only like Rs 5000 total ( tax was 2-3 times more)

The Sudda was honest and had asked to include the bill/receipt in the package. Customs officer was telling me if he didn't have the bill in the package they could have put some low amount and let him go.

But now they have to tax him like crazy due to the receipt. I politely told him I felt not right about our system hassling the Sudda for over a small matter like such. Customs officer told me he felt the same but sadly he can't do anything and felt sorry too!

In summary, I really think Sri Lankan Apartments/Condos are over prices in Colombo and main cities. Add to that with the hassle and lack of facilities in SL, am not surprised we will be in a property bubble if we are already not ( specially wrt to Suddas demand vs supply )

xmart- Top contributor

- Posts : 732

Join date : 2015-01-17

Yes we agree that Condo market is overprices and land prices are skyrocketing. but with the rate of emerging supplies and demand, specially with prominent developments in Colombo i'm still doubtful that whether we had reached the peak or just witnessing the first spark of new trends.

both of your insights opened a path to think more. thanks!

PANTOMATH- Posts : 231

Join date : 2018-10-15

+Rep for both of you

serene- Top contributor

- Posts : 4850

Join date : 2014-02-26

Bubble would be get inflated or deflated in near future when winner comes out from this ugly political tussle.

xmart- Top contributor

- Posts : 732

Join date : 2015-01-17

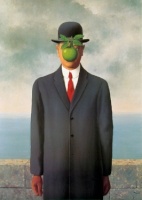

[You must be registered and logged in to see this image.]

The developer, China Harbour Engineering Company says 178Ha with a total gross floor area of 5.6 million square miles will be made available in two phases for real estate development estimated to attract $13 billion in foreign direct investment over the next two decades. Phase I, which includes an international financial centre, beachfront and marina, has seen investors from South Asia, the Middle East, China and Japan expressing interest in developing real estate, the developer says.

- 58Ha Saleable land available to investors under the first phase for hotels, malls, offices and apartments

- 2.6 mnsquare miles – Estimated floor area under phase one

- $4 bnEstimated private investments for phase one

Courtesy from echelon & Central Bank

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

21 July, 2019

Following recent marketing efforts by industry leaders as well as by the Sri Lanka Tourism Board Authority (SLTBA), Sri Lanka’s many affected industries, including tourism, real estate and construction have begun to see a slow regain in momentum.

Following on from the recent terror attacks, several industries, alongside travel and tourism, namely real estate and construction, aviation, and several more were severely affected with a notable decline in enquiries and sales, locally and internationally.

Director Sales and Marketing, Capitol TwinPeaks, Rohith Dissanayake said, “Following recent incidents, Sri Lanka has faced a considerable decline in interest and sales not just in real estate, but within several industries. However, with the international community, local industry leaders and Sri Lanka authorities banding together to ensure safety and continuity of business, we have begun to see the start of Sri Lanka’s rise again”. Properties particularly in the Colombo 1 and 2 area are expected to yield higher investment returns.

[You must be registered and logged in to see this link.]

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 45

» Malwatte Valley to invest Rs 1b on leisure, real estate

» Renuka Holdings embarks on notable real estate development

» Sri Lanka needs real ministers, a real cabinet and a Prime Minister to play monitor

» Sri Lankan developers say property market survived bubble fears

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?