Search

Latest topics

Disclaimer

Information posted in this forum are entirely of the respective members' personal views. The views posted on this open online forum of contributors do not constitute a recommendation buy or sell. The site nor the connected parties will be responsible for the posts posted on the forum and will take best possible action to remove any unlawful or inappropriate posts.

All rights to articles of value authored by members posted on the forum belong to the respective authors. Re-using without the consent of the authors is prohibited. Due credit with links to original source should be given when quoting content from the forum.

This is an educational portal and not one that gives recommendations. Please obtain investment advises from a Registered Investment Advisor through a stock broker

Thread for News on CSE and SL Economy

pjrngroup- Posts : 444

Join date : 2015-11-01

- Post n°451

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°452

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka’s 12-month inflation fell to 4.0 percent in May 2020 from 5.2 percent a month earlier but prices picked up 0.4 percent in the month, data from the state statistics office said.

The Colombo Consumer Price Index, the country’s most widely watched index climbed to 134.2 points in May from 133.6 points in April as the rupee fell steeply amid a unprecedented liquidity injections by the central bank.

Food price index picked up 1.3 percent to 144.1 in May from 142.2 in April, while the non-foods barely rose 0.1 percent.

Sri Lanka’s rupee fell sharply as the central bank printed money in March and April, while a Coronavirus crisis also led to a consumption downturn.

However Sri Lanka has imposed trade controls in a self-imposed import embargo on a series of items including foods.

Sri Lanka cut rates in March as private credit spiked triggering pressure on the currency, but credit is expected to slow in the coming months, while the deficit is expected to rise. (Colombo/May30/2020)

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°453

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

2020 වසරේ මාර්තු මස දෙවන සතිය දක්වා පුළුල් ලෙස ස්ථාවරව පැවති ශ්රී ලංකා රුපියල, කොවිඩ්-19 වසංගතය පැතිරීමත් සමඟ 2020 වසරේ මාර්තු මස අග භාගයේ සිට අප්රේල් මැද දක්වා සැලකිය යුතු ලෙස අවප්රමාණය වූ අතර, 2020 වසරේ අප්රේල් 09 වැනි දින එක්සත් ජනපද ඩොලරයට රුපියල් 199.75ක ඉහළම අගයට ළඟා විය.

කෙසේ වුවත්, එතැන් සිට රුපියල ස්ථාවර වූ අතර, 2020 වසරේ මැයි මාසය තුළ දී සැලකිය යුතු අතිප්රමාණය වීමක් වාර්තා කළේය. එහි ප්රතිඵලයක් ලෙස, 2020 වසරේ අප්රේල් මස 09 වැනි දින දක්වා එක්සත් ජනපද ඩොලරයට සාපේක්ෂව සියයට 9.1කින් අවප්රමාණය වූ රුපියල එම ප්රවණතාව වෙනස් කරමින් සැලකිය යුතු ලෙස අතිප්රමාණය වූ අතර, 2020 වසරේ ජූනි මස 01 වැනි දින වන විට සියයට 2.4ක අවප්රමාණය වීමක් වාර්තා කළේය.

අනෙකුත් විදේශ ව්යවහාර මුදල්වල හැසිරීම පිළිබිඹු කරමින් 2020 වසරේ ජූනි 01 වැනි දින දක්වා වූ කාලපරිච්ඡේදය තුළ දී රුපියල, යූරෝ සහ ජපන් යෙන්වලට සාපේක්ෂව අවප්රමාණය වූ අතර, ස්ටර්ලින් පවුම, කැනේඩියානු ඩොලරය, ඕස්ට්රේලියානු ඩොලරය සහ ඉන්දියානු රුපියලට සාපේක්ෂව අතිප්රමාණය විය.

ශ්රී ලංකා මහ බැංකුවේ 2020 මාර්තු විදේශීය අංශයේ ක්රියාකාරීත්වය වාර්තාවෙහි මේ පිළිබඳ සඳහන් වේ.

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°454

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka’s Securities and Exchange Commission said it had given the nod for rules allowing paper contracts on Colombo Stock Exchange trades to be discontinued and new depository accounts to be opened online without going to broker offices.

“Under the amended rules, Statement of Accounts and Bought and Sold Notes sent by stock broker firms to their clients, and CDS monthly statements sent to account holders will be converted from paper based hard copies to electronic format,” the SEC said in a statement.

“The rule amendments will facilitate the Listed Companies to send Annual Reports to their shareholders in a mode other than in printed form and the payment of dividends through electronic bank transfers.”

The changes were proposed by a SEC – CSE joint committee involved in digitization

“Under this initiative, an online account opening process would also be facilitated whereby an investor could open a CDS (central depository system) Account, start trading and make settlements electronically without the need to physically visit an office of a stock broker.”

Sri Lanka already has internet based trading for stock market investors but settlement documents and cheques are sent by post.

SEC urged stock investors to give their bank account numbers, email addresses and mobile numbers to brokers to get cash and settlement information.

Companies could then also send financial statements online and electronically pay dividends. (Colombo/June03/2020)

nihal123- Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

- Post n°455

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

June, 3, 2020

රජයේ නිවාඩු දිනයක් ලෙසින් ප්රකාශ කර ඇති හා දිවයිනටම බලපැවැත්වෙන පරිදි ඇඳිරි නීතිය පනවා ඇති හෙට (2020 ජූනි 04, බ්රහස්පතින්දා) දිනයේ දී කොළඹ කොටස් වෙළෙඳපොළ දෛනික ගනුදෙනු සඳහා පැය 2ක කාලයකට විවෘතව තැබීමට තීරණය කර ඇති බව එහි ප්රධාන නියාමන නිලධාරී රේණුක විජයවර්ධන නිවේදනය කර සිටී.

මේ අනුව හෙට දිනයේ දී පෙරවරු 11.00 සිට පස්වරු 1.00 දක්වා කාලය තුළ පමණක් දෛනික සාමාන්ය ගනුදෙනු සඳහා කොටස් වෙළෙඳපොළ විවෘතව පවතිනු ඇත.

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°456

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Sri Lanka wins new business providing services to Cruise Ships anchored outside Colombo Port

ECONOMYNEXT – Sri Lanka is providing anchoring, sludging and crew transfer services to two Princess Line ships anchored outside Colombo port which can be seen from Marine Drive and Galle Face, Sri Lanka Ports Authority said.

The cruise ships are the Crown Princess and Island Princess.

“Both the vessels came for sludge and garbage removal, and to receive bunkering services,” Sri Lanka Ports Authority said.

“The Colombo port charges for all the service it provides while sludging and garbage clearance are provided by local agents” officials said.

The Crown Princess disembarked 479 crew members out of which 380 were Indians and 99 Indonesians, while Island Princess disembarked 277 Indians.

The Indonesians had then joined the Island princess while the Indians were flown home.

“Ultimately 600 odd Indian crew members were flown back via a charter flight while the ships cleared sludge and garbage,” Sri Lanka Ports officials told EconomyNext.

“We provide the services using the available technologies and these crew changes take place without the direct involvement of Sri Lankans,” the said.

Sri Lanka halted cruise tourism in early March as the Coronavirus spread to Europe and US, however, it is allowing cruise liners to dock in Colombo for supplies, fuel and crew changes on humanitarian grounds.

Sri Lanka started crew transfer services last month. Airport and Aviation Services and Island’s ports are working together to help ships change crew as most of the airports remain closed.

The Aviation authority said that crew transfer service is a new business opportunity created due to the COVID pandemic.

“We are getting paid for the services we provide but more than the economic gain, the positive impact on Sri Lanka’s ports and its reputation will be highlighted,

“We are giving a signal out to the world that we are trying to provide services in times of a pandemic. We have taken the lead in the region compared to other regions.

Officials at the port’s authority say that these services provided amid a pandemic will immensely help Sri Lanka’s in its promotion strategy for cruise tourism.

Even before COVID-19 hit Sri Lanka, there were large number of ships scheduled to call in Colombo. In March alone there were 29 ships scheduled to visit.

“By providing all these services, we are anchoring the business for the long term”.

(Colombo/June03/2020)

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°457

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Banks get relief from moratorium

After several weeks of discussions, the Central Bank of Sri Lanka (CBSL) last week granted a request by the banking sector to allow them to charge interest from lenders who are under the Covid-19 moratorium, The Sunday Morning Business learns.

The moratorium that was announced in March after the local spread of the coronavirus pandemic, had waived off interest rate payments, depriving interest income earned by banks, thereby leading to cash flow issues.

A senior banker confirmed to The Sunday Morning Business that banks are now permitted to charge interest up to 7% per annum, which has to be paid in Equal Monthly Instalments (EMI).

“During the moratorium period, banks can apply a 7% interest rate per annum. This applies to any moratorium,” the banker added.

Even though it is less than what banks actually requested and would not cover the full exposure of the moratorium, it is learnt that banks have agreed to this compromise. Nevertheless, according to the banker, banks will still endure the financial impact of this moratorium, but have agreed to support their customers.

The industry made a request from the CBSL a couple of weeks ago to be allowed to charge at least a component of the interest on loans that was completely waived off under the moratorium.

This request was made to ensure banks have sufficient cash flow to pay interest income to their depositors, as the moratorium as it stands deprives banks of interest income for half a year, creating severe cash flow issues.

Following the local spread of Covid-19, the CBSL announced financial relief in late March for selected industries due to the financial struggles endured as a result of the islandwide curfew.

Issuing a circular on 24 March, a few days after the imposition of the islandwide curfew, the CBSL announced a six-month debt moratorium for affected industries comprising that of small and medium enterprises (SME), tourism, apparel, plantation, IT, and related logistics service providers.

In the same circular, the CBSL instructed financial institutions to provide working capital requirements at an interest rate of 4% and waive off interest payments for at least six months for the aforementioned sectors.

According to JB Securities estimates, around 30% of loans to the private sector from the banking sector will be under moratorium. Based on the current weighted average lending rate of 13%, the day one loss on the carrying value of these loans, assuming an average moratorium period of 4.5 months, will be Rs. 94 billion. This goes up to Rs. 125 billion if the average period increases to six months.

They have also estimated that Rs. 50 billion of this loss can be offset from the reduction in the tax burden from 52% to 40%, due to the recent tax cuts computed on last year’s post-tax profits; the balance will have to be borne by a combination of labour cost savings (cuts to bonuses), other cost savings, higher margins, and lower profits.

A week after the announcement of the moratorium, the CBSL announced a Rs. 50 billion refinancing facility to financial institutions, to implement the debt moratorium on capital and interest, and a working capital loan for Covid-19-hit businesses and individuals. However, last week, the Cabinet has expanded this refinancing facility to Rs. 150 billion.

Licensed commercial banks (LCBs), licensed specialised banks (LSBs), licensed finance companies (LFCs), and specialised leasing companies were made eligible to participate in this refinancing facility which commenced in late March.

In addition to this moratorium, banks are instructed to provide two other debt moratoriums under the circular issued in March, along with a number of relief measures for sectors affected by Covid-19, all of which involve assistance from financial institutions.

Financial institutions were instructed to implement a debt moratorium on capital and interest, which includes a six-month moratorium on leasing rentals of all three-wheelers, school vans, lorries, small good transport vehicles, and buses operated by the self-employed, and a moratorium until 30 May on personal loans and lease rentals valued at less than Rs. 1 million.

Around 3% of private sector credit was outstanding to the tourism sector as at the end of 2019, totalling Rs. 240 billion. Of this amount, Rs. 100 billion is under a one-year moratorium.

Backstage- Top contributor

- Posts : 3803

Join date : 2014-02-24

- Post n°458

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°459

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka has recorded a budget deficit of 443 billion rupees or about 2.8 percent of gross domestic product in the first quarter of 2020 amid slightly lower revenues, Finance Ministry data showed, mostly due to a spike in spending.

Total revenues were 420 billion rupees down from 442 billion rupees a year earlier, partly helped by non-tax revenues working out to about 2.9 percent of gross domestic product.

Sri Lanka is expecting full year revenues of 1,450 billion rupees or 9.2 percent of GDP down 440 billion rupees, amid tax cuts and an economic downturn from Coronavirus.

Stimulus

The tax cuts or ‘fiscal stimulus; which, coupled with rates cuts and liquidity injections which led to forex shortages, helped trigger a rating downgrade and a sell-off sovereign bonds.

Earlier data showed that Sri Lanka had recorded 50 billion rupees of non-tax revenues, up to February 2020, helped by a 24 billion rupee profit transfer made as a liquidity injection which expanded reserve money.

It was the first of the so-called ‘helicopter drops’ of printed money which triggered forex shortages, raised fears about the ability to repay foreign debt, and has now led to severe import controls which is further hitting businesses and the economy, undermining a recovery from a Coronavirus crisis.

Related

Sri Lanka prints more money as rating downgraded to just above CCC

Sri Lanka prints more money, after slapping forex controls amid IMF warning

Though many countries went through Coronavirus lockdowns which hit economic activity, Sri Lanka has slammed tight import controls not seen since the 1970s, in the wake of unprecedented money printing and ‘stimulus’.

The ‘Nixon shock’ style hit on the economy is expected to further hit state revenues, businesses, worsening bad loans.

Spending

The finance ministry said current spending rose to 715 billion rupees from 576 billion rupees (about 4.6 percent of GDP).

Sri Lanka had to settle payment arrears and unaccounted for expenditure carried forward from 2019, where a deficit of 6.8 percent was recorded, the finance ministry said.

“The actual deficit for 2019 would be 9.0 percent of GDP with the inclusion of all unpaid claims,” the Finance Ministry said.

Related

Sri Lanka says settles Rs196bn in 2019 budget arrears

Sri Lanka however accounts for the budget on a cash basis, directly showing the impact on the credit system from government fiscal activities and there is no accrual budgeting to confuse users of budget data.

Sri Lanka has had a practice of carrying over payment some arrears to the following year.

Monetary Stability

In 2019 Sri Lanka did not print large volumes of money and sterilized dollar purchases steadily until around July 2020, keeping the external sector stable, the balance of payments in surplus, and the ability to repay foreign loans intact.

Data showed that108 billion rupees of liquidity had been mopped up, helping build forex reserves in 2019. In 2018, when there was balance of payments trouble and a credit downgrade 246 billion rupees was printed.

The current account deficit of the budget or the gap between total revenues and current spending rose to 295 billion rupees in the first quarter of 2020 or 1.9 percent of GDP, up from 133 billion rupees a year earlier.

Capital expenditure for the first quarter was 150 billion rupees, marginally down from 154 billion rupees a year earlier, taking the overall deficit to around 440 billion rupees or about 2.8 percent of GDP, up from 287 billion rupees a year earlier.

The overal deficit for the quarter is a little higher than total revenues, for the quarter, showing the pressure on finances. No separate data on grants were available, but up to February 1.9 billion in grants had been received.

Sri Lanka is expecting an overall budget deficit of about 8.5 percent for the full year or 1,349 billion rupees, up from 1,016 billion rupees a year earlier, or a little under revenues.

Cashflows

In the first quarter 360 billion rupees were allocated for loan repayment, the finance ministry said.

The 2020 budget is planning to raise 850 billion rupees from domestic markets and 491 billion rupees from foreign sources to finance the 1,341 billion rupee expected deficit.

Sri Lanka has not passed a budget for 2020 in parliament and only passed a vote-on-account for the first four months of the year.

A mini-budget was prepared for March to June and a second one till August citing presidential powers involving total outlays of 1,224 billion rupees which includes debt repayment.

The outlays for the Department of Treasury operations were 628.5 billion rupees, of which 268.42 billion rupees was for current spending and 360.1 billion rupees for capital payments.

A mini-budget from June to August showed outlays of 1,043 billion rupees of which 644 were for current spending and 398 billion rupees for capital, including debt repayment.

The outlays for the Department of Treasury operations were 486 billion rupees, of which 224.42 billion rupees was for current spending and 262.0 billion rupees for capital payments.

(Colombo/June11/2020)

https://economynext.com/sri-lanka-2020-first-quarter-budget-deficit-rs440bn-revenues-lower-70959/

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°460

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka’s forex reserves dropped 686 million US dollars to 6,493 million US dollars in May 2020 from a month earlier, official data showed, following a 353 million dollar fall in April amid liquidity injections.

Sri Lanka’s forex reserves began to drop after February 2020, in the wake of a pro-cyclical rate cut in January 2020, despite a worsening deficit from tax cuts.

The roots of the current crisis began when liquidity disruptions and injections began in July 2020 halting the ability of the central bank to mop up inflows and the steady built up forex reserve halted.

At the time however private credit was still weak as the credit system had still not recovered from a currency crisis in 2018.

A pro-cyclical rate cut in April 2018 and liquidity injections shortly before the policy error triggered the 2018 crises. It was worsened by Soros-style swaps in July/August and a political crisis in October.

In April 2018, at the time the pro-cyclical cut was made Sri Lanka was recovering from 2015/2016 currency collapse.

The pro-cyclical rate that speeded the 2015 crisis was made in April 2018, but liquidity injections started in the last quarter of 2014, when a strong recovery was seen from a 2012 currency crisis.

The gap between currency crises have narrowed due to a combination of discretionary flexible inflation targeting (monetary policy based on a domestic anchor) and call money rate targeting with pro-cyclical excess liquidity while also running an unstable peg to collect reserves (flexible exchange rate).

In the current currency drop, after which authorities slapped severe import controls up to 160 billion rupees of excess liquidity was printed.

Private credit began to fall in April amid Coroanvirus curfews and consumption had also fallen with retail shops closed.

After selling 98 million US dollars dollars to defend the currency against the new liquidity, the central bank had bought 61 million US dollars in May to stop the appreciation of the rupee amid weak private credit, data show.

Gross official reserves also include Treasury dollar assets and they may drop due to loan repayments.

Sri Lanka’s budget had deteriorated in 2020 with at least 850 billion rupees of domestic borrowings expected. Tax cuts for fiscal ‘stimulus’ and forex shortages from liquidity injections had also triggered a rating cut to ‘B-‘.

Generally weak private credit, in the wake of a currency crisis allows the government to borrow more than when the economy is doing well. (Colombo/June13/2020)

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°461

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Sri Lanka SEC chief meets CB Governor on EPF stock purchases, central counterparty

ECONOMYNEXT – Chairman of Sri Lanka’s Securities and Exchange Commission Viraj Dayaratne has met Central Bank Governor W D Lakshman for talks on Employee Provident Fund investments in stock and a central counterparty for clearing, the regulator said.

“This meeting provided an opportunity for the Governor and the Chairman to share and exchange views on issues of mutual interest as well as certain specific matters regarding which the SEC required the support of the Central bank,” the regulator said.

Dayaratne had explained that there had been a World Bank backed project to set up a central counter party mechanism (which cuts settlement risks) for all securities transactions but the central bank had limited it to forex and government securities.

“The Chairman explained the importance of including equity as well in the CCP…” the SEC said.

The CPP will enhance investor confidence and especially foreign investors, the SEC said.

The SEC had also discussed the prospects for the Employees Provident Fund, a pension fund of private sector employees managed by the state, to invest in stocks with ‘suitable due diligence.

“Such a move is expected to provide above average returns to members of the EPF and also would invigorate the capital market,” the SEC said.

Investments by the EPF in stocks had been controversial in the past, with investors who were stuck with some large parcels bought at high prices using it to exit. (Colombo/June15/2020-sb)

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°462

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

නිෂ්පාදන අංශයේ ගැනුම් කළමනාකරුවන්ගේ දර්ශකය ඉහළට

නිෂ්පාදන අංශයෙහි ගැනුම් කළමනාකරුවන්ගේ දර්ශකය 2020 මැයි මාසයේ දී සැලකිය යුතු ලෙස වර්ධනය වෙමින් 49.3ක අගයක් වාර්තා කළේය. මෙය අප්රේල් මාසයෙහි වාර්තා වූ සමීක්ෂණය ආරම්භයේ සිට මෙතෙක් පැවති අවම අගය වන 24.2ට සාපේක්ෂ ව දර්ශකාංක 25.1ක ඉහළ යෑමකි. සංචරණ සඳහා පනවා තිබූ නීති ක්රමයෙන් ලිහිල් කිරීම, නිෂ්පාදන අංශයෙහි ආර්ථික ක්රියාකාරකම් යථාවත් වීම කෙරෙහි ප්රධාන ලෙස දායක විය.

විශේෂයෙන් ආහාර හා පාන වර්ග නිෂ්පාදන අංශයෙහි සහ රෙදිපිළි හා ඇඟලුම් නිෂ්පාදන අංශයේ නිෂ්පාදිත පරිමාවේ සිදු වූ සැලකිය යුතු ඉහළ යෑම පිළිබිඹු කරමින්, නිෂ්පාදන උප දර්ශකය, 2020 අප්රේල් මාසයේ දී වාර්තා කළ 3.5ක අගයට සාපේක්ෂ ව, 2020 මැයි මාසයේ දී 51.1ක ඉහළ අගයක් වාර්තා කළේ ය. තව ද, නව ඇණවුම්, තොග මිලදී ගැනුම් හා සේවා නියුක්ති උප දර්ශක ද 2020 මැයි මාසය තුළ සැලකිය යුතු ලෙස වර්ධනය වූ නමුත් තවදුරටත් කඩයිම් මට්ටමට වඩා පහළ අගයක පැවතුණි. මේ අතර, සැපයුම් දාමයේ පැවති අවහිරතා ක්රමයෙන් සමනය වන බවට පිළිබිඹු කරමින් මෙම කාල සීමාව තුළ ඇණවුමක් සැපයීමට සැපයුම්කරුවන්ට ගත වන කාලය අඩු වේගයකින් ඉහළ ගියේය.

රෙදිපිළි හා ඇඟලුම් නිෂ්පාදන අංශයේ සහ රසායනික හා රසායනික ද්රව්ය නිෂ්පාදන අංශයේ ඇතැම් ප්රතිචාර දැක්වූවන් අවධාරණය කළේ තම නිත්ය නිෂ්පාදන සඳහා මෙතෙක් ඇණවුම් ලැබී නොමැති බැවින් ඔවුන් එයට විකල්පයක් ලෙස සෞඛ්ය ආරක්ෂාව හා සම්බන්ධ නිෂ්පාදන නිපදවීම කෙරෙහි යොමුවී ඇති බවයි.

COVID-19 වසංගතය හේතුවෙන් පාරිභෝගික ඉල්ලුම කෙරෙහි තවදුරටත් පවතින අහිතකර බලපෑම් පිළිබඳ ප්රතිචාර දක්වන්නන් සැලකිලිමත් වුවද නිෂ්පාදන ක්රියාකාරකම් පිළිබඳ ඔවුන්ගේ අපේක්ෂාවන් පසුගිය මාසයට සාපේක්ෂව සැලකිය යුතු වැඩි වීමක් පෙන්නුම් කරයි.

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°463

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Economic sentiment rallies – Survey

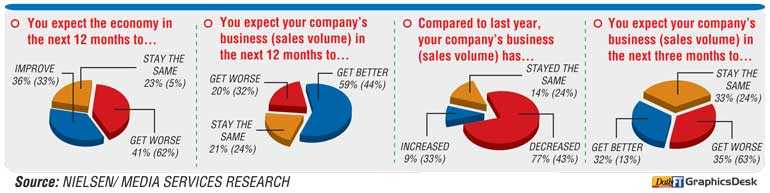

Sentiment surrounding the economy picked up slightly in May with 36% of respondents to the latest LMD-Nielsen Business Confidence Index (BCI) survey saying it will improve in the next 12 months (versus 33% in April).

In addition, the share of businesspeople expecting economic conditions to worsen during this period has declined to 41% (from 62% in the previous month).

As for the outlook for business, nearly six in 10 of corporate executives consulted by Nielsen expect their sales volumes to increase in the coming 12 months while almost a third anticipate an improvement in the next three months.

In contrast, poll participants feel that the investment climate has deteriorated with a mere 9% of businesspeople considering this a good time to invest in the country while a majority (69%) perceive conditions as ‘poor’ or worse. Furthermore, 22% of executives polled describe conditions as ‘fair.’

Media Services, which publishes LMD, says the June edition of the magazine has been released. Its digital edition is also available on WhatsApp and the publisher’s social media platforms.

LMD’s Cover Story features an exclusive interview with the Chairperson and Managing Director of Unilever Sri Lanka Hajar Alafifi Laadel, in which she discusses her vision for business particularly within the context of the FMCG sector, taking stock of the impact of the COVID-19 pandemic and the ensuing economic fallout (for the full story, log onto www.LMD.lk).

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°464

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Manufacturing activity has rebounded strongly in May 2020 as Sri Lanka emerged from a Coronavirus crisis with some firms switching products, while services also started to recover, a Purchasing Managers Index compiled by the central bank showed.

Hotels were still down in services and companies were not replacing retirees, leading to a tick up in unemployment.

Manufacturing PMI rebounded to 49.3 points in May after plunging to a record low of 24.2 in April as Coronavirus lockdown gripped the country. A global PMI index showed a gain of 2.6 points to 42.4 in May.

A production sub-index had bounced back to 51.1 in May from 3.5 in April with volumes rising gin food, beverages, textiles, and apparels.

“The gradual easing of restrictions for mobility has contributed to the resumption of economic activities in the manufacturing sector,” the Central Bank said.

“Further, New Orders, Stock of Purchases, Employment sub-indices also improved during the month of May 2020, yet remained below the neutral level.

“Meanwhile, Suppliers’ Delivery Time lengthened at a slower pace during the period signalling a softening of stress on supply chain.”

Many companies in textile, apparel, chemicals had said they had switched to health and safety related products as they had no orders for regular products.

The Services sector PMI also gained to 43.1 points in May to 29.8 in April.

“This increase was underpinned by increases observed in New Businesses, Business Activities and Expectations for Activity sub-indices, ” the Central Bank said.

Transport, wholesale and retail trade had improved with the lifting of restrictions.

But hotels and tourism and food and beverages had declined amid restrictions on hotel operations and zero foreign arrivals.

“Further, respondents in Services sector are optimistic on future business activities with the expected revival of economic activities aftermath of COVID-19 pandemic,” the central bank said.

“However, Employment declined in May 2020 compared to previous month due to halt of new recruitments amidst retirements.” (Colombo/June16/2020)

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°465

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka has cut the statutory reserve ratio (SRR) reducing the share of deposits that banks have keep in the central bank to 2.0 percent from 4.0 percent, releasing 115 billion rupees into the credit system.

The liquidity injection came hours after President Gotabaya Rajapaksa summoned Governor W D Lakshman and top officials to his office to give them a dressing down for not expanding a Zimbabwe style quasi-fiscal re-finance facility by 100 billion rupees to 150 billion rupees.

“The financial sector is expected to pass the benefit of the high level of liquidity and the reduced cost of funds to the economy without delay, by increasing lending to businesses and households at low cost,” the central bank said.

“The Monetary Board will continue to monitor economic and financial market developments and will take further policy and regulatory measures to support a sustained revival of economic activity in the period ahead.”

The central bank said the SRR has been cut 200 basis points so far this year, policy rates have been cut 150 basis points and several other measures have also been taken.

The SRR is an archaic rule that needlessly raises the cost of funds of banks, but the liquidity injection comes at a time when Sri Lanka’s forex reserves are declining and the country has faced forex shortages and rating downgrade after earlier money printing and tax cuts.

The liquidity injected though the SRR cut is about 600 million US dollars at current exchange rate indicating that a similar amount of reserves would be lost to stop the fall of the rupee when the new money turns into credit.

Sri Lanka’s forex reserves had dropped by 1,032 million US dollars to 6,493 since rate cuts and money printing began from January 30.

Data showed that about 90 billion rupees of excess liquidity remained in the banking system from money printed in April and June, which could cost about 480 million US dollars to mop up in forex markets or allow the exchange rate to fall, unless they were mopped up through domestic operations.

President Rajapaksa slammed central bank officials saying they are getting high salaries but had failed to regulate finance companies and there had been a bondscam.

“All at the Central Bank are economic specialists drawing very high salaries,” he said hours earlier. “You have a responsibility. I have presented you a mechanism.

“If you are unable to follow it, present me your version of the mechanism by tomorrow morning.”

https://economynext.com/sri-lanka-cuts-reserve-ratio-by-2-0-pct-injects-rs115bn-into-banks-71138/

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°466

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka’s central bank said it will issue more new money to banks at 1.0 percent to give loans under credit schemes which will take the total up to 150 billion rupees , while also cutting a reserve ratio releasing another 115 billion rupees to the credit system.

The central bank said 27.5 billion rupees had already been given by banks from a 50 billion rupee re-finance facility introduced earlier.

More funding will be provided to banks against a “broad spectrum of collateral, on the condition that LCBs in turn will on-lend to domestic businesses at 4.00 per cent, while ensuring the greatest possible distribution of this facility,” the central bank said.

The central bank cut the reserve ratio and announced the credit schemes hours after President Gotabaya Rajapaksa slammed the monetary authority after summoning Governor W D Lakshman and senior officials to his office for not raising a new money financed credit to 150 billion rupees.

“This scheme along with the existing refinance Scheme will provide Rs. 150 billion in total to the businesses affected by the COVID-19 pandemic,” the central bank said.

Operating instructions on these new credit schemes will be issued in immediate due course.”

Contractors of government projects will be given loans on a government guarantee equal to contract values of projects which were in arrears under another central bank re-financed credit scheme.

The new injections come as foreign reserves have dropped over a billion US dollars to 6.4 billion US dollars since rate cuts and liquidity injections began.

Related

Sri Lanka cuts reserve ratio by 2.0-pct, injects Rs115bn into banks

Sri Lanka President slams central bank over Rs150bn quasi-fiscal re-finance

The full statement is reproduced below:

Central Bank of Sri Lanka Implements New Credit Schemes to Support the Revival of the Economy

Growth of the Sri Lankan economy has fallen to dismal levels over the past few years, and the impact of the COVID-19 pandemic may result in severe stress on economic and financial system stability in the period ahead unless immediate remedial actions are taken. In this context, in support of the government’s efforts to revive the economy, the Monetary Board of the Central Bank of Sri Lanka, at its meeting held on 16 June 2020, decided to introduce new credit schemes under the Section 83 of the Monetary Law Act No. 58 of 1949.

Accordingly, in addition to the already disbursed Rs. 27.5 billion under the refinance scheme introduced on 27 March 2020, the Central Bank will provide funding to Licensed Commercial Banks (LCBs) at the concessionary rate of 1.00 per cent against the pledge of a broad spectrum of collateral, on the condition that LCBs in turn will on-lend to domestic businesses at 4.00 per cent, while ensuring the greatest possible distribution of this facility.

This scheme along with the existing refinance Scheme will provide Rs. 150 billion in total to the businesses affected by the COVID-19 pandemic.

In addition, the construction sector enterprises will be provided with a facility to borrow from LCBs, using guarantees issued by the government equivalent to the amount due on account of contracts carried out in the past, under a new dedicated credit scheme funded by the Central Bank and made available at the aforementioned concessionary rates.

Operating instructions on these new credit schemes will be issued in immediate due course.

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°467

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

HCL Technologies (HCL), an Indian multinational information technology (IT) service and consulting company that is currently in the ‘Forbes Global 2000’ list, has become Sri Lanka’s first FDI (Foreign Direct Investment) since the COVID-19 outbreak in the country in March.

According to the Corporate Vice President of HCL, Srimathi Shivashankar, the company is set to invest USD 10 million in the coming years as a capital expenditure, limiting its use towards IT equipment, training and leasing needs. In an online media briefing held today (16), she stated that the company will also look at hiring around 5,000 people in the next three to five years, with the first 1,500 being hired in the next 18 months.

HCL plans to create these new local employment opportunities for both freshers and experienced professionals. Shivashankar stated that a key part of HCL’s business and development strategy in Sri Lanka will be to use local talent pool for global assignments.

“We are very excited as our operations have already started in the region and are looking forward to hiring and engaging with the highly skilled and talented people of Sri Lanka while bringing them the opportunity of working with a global technology company, at their door-step without having them to move out of their own country. Our delivery center in Sri Lanka will play an important role to serve our Fortune 500 and Global 2000 clients and partners throughout the globe.”

HCL’s commencement of operations in Sri Lanka began in February 2020, when they joined hands with the Board of Investment (BOI) of Sri Lanka. HCL Technologies Lanka also marked the presence of the company’s first delivery center in the region. HCL is set to provide services to global clients in the areas of Applications & System Integration Services and Infrastructure Services.

During the online event, the Chairman of the BOI, Susantha Ratnayake stated that this was a significant step in the direction of the vision HCL has set out for building its global delivery center in Sri Lanka. He went on to state that he was hopeful that HCL will be able to create employment opportunities for the people of the country and people of Sri Lanka will have access to global work environment right in their own country.

“We are extremely happy that HCL has come to Sri Lanka. This will broaden the horizons of young people, because they will get to work with an international company with the best-in-class systems and processes and open up Sri Lanka for the 250 of the Fortune 500 and 650 of the Global 2000 companies, which are HCL’s customers.”

HCL Technologies is a subsidiary of HCL Enterprise, and currently has offices in 44 countries including the United Kingdom, the United States, France, and Germany with a worldwide network of R&D, “innovation labs” and “delivery centers”, and around 147,123 employees. As of 31 March this year, HCL has consolidated revenue of USD 9.94 billion.

slstock- Veteran

- Posts : 6216

Join date : 2014-06-12

- Post n°468

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

"HCL has consolidated revenue of USD 9.94 billion".

WOW!

What the highest revenue earning SL company?

How much!

We have such a long way to go !

_________________

Never listen to anyone including myself without your own study. Only few truly genuine people exist in this world.

Please read : https://forum.lankaninvestor.com/t1548-important-warning-and-message

---------

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°469

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

First Capital expects further cuts in policy rates

First Capital Research believes that the Central Bank of Sri Lanka is yet again in a vulnerable position and the possibility of a policy rate cut is on the cards in order to push banks to consider the lending opportunities.

The research firm allocates a policy rate cut expectation of 100bps bringing the SDFR and SLFR to 4.50% and 5.50%, respectively.

“Despite prevailing the low interest rate environment it will have a ripple effect on the overall economy,” the research firm said in its latest report.

According to First Capital Research, the Central Bank presumes the excess liquidity may factor in as a stimulus for LCB’s to lend to businesses in support of the government’s efforts to revive the economy.

“On the contrary, LCB’s may expedite this as an opportunity to position in either short term treasury instruments or under SDF facility interest rate deriving a substantial interest on the deposit.”

“Thereby, the possibility exists that bulk of the money may not move into the revival of businesses via credit schemes, therefore, the intention of CBSL may not materialize,” the research firm said.

On 16th Jun 2020 CBSL has reduced SSR by 200bps from 4% to 2%. The reduction is expected to release over LKR 115Bn of liquidity into the banking system, allowing banks to accelerate credit flows into the economy, while reducing cost of funds.

“We expect LKR 100Bn top-up, in the existing refinance scheme which may enhance additional liquidity to the domestic money market above LKR 250Bn,” First Capital Research said.

At the current level of LKR 221Bn (17th Jun) excess liquidity is already at a 16-year high. Further top-up in existing refinance scheme may push CBSL Holding (printed money) closer to LKR 500Bn from current LKR 317Bn.

Moreover, the research arm stated that with the liquidity position surging over LKR 200Bn and bulk of the excess liquidity likely to be parked in short term Government Securities, they expect a significant downward pressure on the Yield curve Considering the possibility of a major rate cut to discourage using of the SDFR facility, we expect an accelerated downward pressure on the yield curve.

Further, the Government has decided to expand its quasi-fiscal re-financing facility from LKR 50Bn to LKR 150Bn requiring additional LKR 100Bn funding for planned disbursement.

“The remedial action to revive the economy may further boost liquidity in the system which as mentioned prior may push CBSL Holdings closer to LKR 500Bn,” it said.

In their previous recommendation First Capital Research expected a further surge in liquidity in 2Q3Q which may bring yields by 25-50bps.

“However, the current SRR cut, possible policy rate cut, and additional LKR 100Bn funding may bring the yields further down, thereby we bring down their bond yield bands by 125-150 bps,” the research firm said.

Further, the First Capital Research believes that Lacklustre 2Q & 3Q & CBSL intentions may push short term rates down for a limited period

With the Government’s intention to open up the economy and CBSL’s push to lower interest rates, there are caps being imposed on the recent Bill & Bond auctions which illustrates the intention of the CBSL to maintain lower rates in order boost economic activity and growth.

Considering the risks in the system and the worsening macro indicators First Capital Research prefers to maintain our bond yield bands at the mentioned levels in the previous slide

“However, with the lacklustre 2Q & 3Q, possible further increase in CBSL Holdings while also considering the intentions and the new rules of the CBSL to push rates lower, we would like to highlight that short-mid term yields may decline by 25-50bps for a very limited period,” the research firm said.

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°470

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka’s budget deficit may reach 9.3 percent of the gross domestic product in 2020 and foreign debt repayment pressure would continue beyond elections in August when the economic policy may improve Fitch Ratings said, amid more liquidity injections into the banking system.

Fitch downgraded Sri Lanka’s sovereign rating to ‘B-‘ from ‘B’ as unprecedented money printing in March 2020 after earlier rate cuts triggered foreign exchange shortages putting pressure on the currency and making it more difficult to repay foreign debt.

Sri Lanka has not yet come into a program with the International Monetary Fund with the earlier program expiring on June 02.

Fitch said tax announced by the new administration went contrary to the IMF program’s “revenue-based consolidation strategy” to cut deficits over time.

Sri Lanka’s finance ministry is forecasting an 8.5 percent of gross domestic product deficit for 2020 now.

“We continue to forecast a wider budget deficit, at 9.3 percent, due to our forecast that GDP will contract by 1.3 percent,” Fitch said.

Sri Lanka’s foreign reserves had fallen after February 2020 when money printing began and there was a pick up in domestic credit both from the private sector and the deficit. In April private credit hit a road-block amid Coroanvirus curfews.

Elections

There could be more clarity on economic policy after elections are held on August 05, but external pressure could continue, Fitch said.

Gross official reserves which including fiscal balances had fallen to 6.5 billion US dollars by May.

The country’s external liquidity ratio (defined by Fitch as liquid external assets as a percentage of liquid external liabilities), at around 60 percent in 2019, is among the lowest in its B rating category.

Sri Lanka has applied to a new IMF program that has not yet been negotiated.

“This level of coverage is low relative to sovereign external debt that is due to the rest of this year,” Fitch said.

“Sri Lanka has yet to receive external financing from the IMF in 2020, either as part of emergency support during the coronavirus pandemic or as part of a regular programme.

“Greater clarity on the government’s medium-term economic policies after the elections are held could facilitate such financing, but agreeing on policies to place public finances on a consolidation path will be challenging.”

External Stress

The ratio of debt to fiscal revenue, at close to 900 percent which was is far above the ‘B’ median of 350 percent.

“We believe the government will be able to finance its maturing external debt in 2020 through loan disbursements from bilateral and multilateral agencies, apart from the sovereign bond obligation that is due, which we assume will be met out of reserves,” Fitch said.

Sri Lanka has to repay around 3.8 billion US dollars in foreign debt for the rest of 2020, Fitch said.

Yields on Sri Lanka’s sovereign bonds have risen, making it difficult to roll-over bonds.

“Our projections do not assume access to international capital markets or IMF support in 2020, but do incorporate an expectation that Sri Lanka will regain market access in 2021 when external financing conditions improve,” Fitch said.

“Sri Lanka’s debt servicing obligations over 2021-2025 are substantial, amounting to an average of USD4.3 billion per year.

“We cited a further increase in external funding stress, reflected in a narrowing of funding options and weaker refinancing capacity, threatening Sri Lanka’s ability to meet external debt repayments, as a potential negative rating sensitivity in April when we downgraded the sovereign rating.’

Sri Lanka’s central bank has announced a 150 billion rupee re-financing facility (printed money) for bank credit for Coronavirus hit businesses, despite the problems with forex reserves after President Gotabaya Rajapaksa blamed the bank for not increasing the facility from an original 50 billion rupees.

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°471

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Sri Lanka remittances down 23-pct in May but up from April

ECONOMYNEXT – Sri Lanka’s foreign remittances fell 23.3 percent from a year earlier to 431.8 million US dollars in May 2020 but has picked up from a low of 375 million US dollars in April amid a Coronavirus pandemic, official data shows.

Sri Lanka was under strict lockdowns in April with banks only operating a few hours and postal services also not operating.

Expatriate family members in the Middle East and elsewhere send money either through bank drafts over the post or through a transfer which may cost more.

Sri Lanka’s official remittances which were trending down in 2019 started to pick up from December.

In January 2020 remittances grew 6.5 percent to 580.9 million US dollars. In February remittances were up 5.4 percent to 527 million US dollars.

Many Sri Lankans whose contracts had expired were unable to come to Sri Lanka after inward arrivals were banned from all countries after March 19.

Since then overseas Sri Lankans are being brought back according to availability of quarantine facilities.

“We believe that around 1.3 million Sri Lankan or more may be working abroad,” Information Minister Bandula Gunewardene said.

“For many reasons only a relatively small number has indicated to overseas that they want to come back.

Of that 52,401 from 117 countries had informed Sri Lankan missions abroad that the wanted to come back by June 16, he said

“We have brought back about 10,000 persons so far.”

Based on Foreign Ministry data by the third week of June 9,580 persons have been brought back from 38 countries.

Foreign missions were also distributing dry rations to person who had lost jobs, he said. (Colombo/June30/2020)

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°472

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Central bankers cannot solve economic problems and large liquidity injections will lead to devaluations, though most emerging market currencies including Sri Lanka’s have been relatively stable in the Coronavirus pandemic, a global investor said.

“Central bankers are not in a position to recover economies or generally solve all these economic problems,” Mark Mobius, an emerging market investor said in a webinar with Colombo-based John Keells Stock Brokers.

“But unfortunately people demand the central banks to do something. So the central banks keep on printing money. In the US the central bank is buying bonds – commercial bonds. And this is releasing a lot of liquidity into the economy.

“But I believe that it is important that central bankers aren’t put into that position because they cannot really do much to help the economy.”

He was responding to his view on Modern Monetary Theory, a 21st century revival of the ideas of the like of Scottish Mercantilist John Law, coupled with heavy state interventions.

MMT came to the fore amid a depression style de-leveraging in the US and elsewhere after a massive housing and commodity bubble fired by the Federal Reserve collapsed in 2008, in a repeat of John Law’s Mississippi Bubble.

Keynes, general theory, which some classical economists say should never have been called a ‘general’ theory, gained ground in the depression era when banks were damaged and there was de-leveraging.

The massive money printing recently has not shown much inflation, partly due to productivity gains by companies, Mobius said.

“The result of that is not inflation but devaluation of currencies,” Mobius said.

Most emerging market currencies have been relatively stable in the crisis, he said.

Sri Lanka’s rupee has been relatively stable with a 7 percent devaluation and some recovery. Single digit changes in currency was “not a very big problem” he said.

“You probably not want to have big swings in currency,” Mobius said. “That is not a healthy thing.”

He said central banks were printing money into the banking system but banks would ask ‘why should we put money into companies that are going under?’ he said.

“But I believe that it is important that central bankers aren’t put into that position because they cannot really do much to help the economy,” he said.

“That is why lockdowns will have to end.”

People will have to go back to work to make economies work. Most countries will be forced to re-open economies, Mobius said.

“The solution is not money, the solution is more jobs,” he said.

He expected to global tourism to recover as people were impatient to move after being trapped in lockdowns. (Colombo/June29/2020 – Update II)

Rajapaksap likes this post

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°473

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jun 30, 2020 (LBO) – First Capital Research believes that there is a higher likelihood of 90% that CBSL may provide a rate cut to ensure the continued supply of credit at a low cost of funding.

The firm also believes that there is a probability of 40% for a 100bps rate cut to bring it closer towards the 4% special working capital lending rate and thus to discourage the LCBs from using the SDFR facility.

With the recent reduction of SRR additional LKR 115Bn of liquidity was injected into the banking system, allowing banks to accelerate credit flows into the economy while reducing cost of funds.

As a result of the injection of liquidity to the system, CBSL holdings recorded a significant increase of more than LKR 200Bn since 13th Mar 2020.

“We expect LKR 100Bn top up, in the existing refinance scheme which may enhance additional liquidity to the domestic money market above LKR 250Bn At the current level excess liquidity is already at a 16 year high,” First Capital said in a research note.

Further top-up in the existing refinance scheme may push CBSL Holding (printed money) closer to LKR 500Bn from current LKR 311Bn.

“To dissuade banks from keeping excess money with the CBSL without lending, we believe that the CBSL has to reduce its policy rates substantially both SDFR, the rate at which commercial banks can keep overnight liquidity with the CBSL, and the SLFR, as a stimulus to boost the credit growth.”

In order to discourage LCBs in using the facility of SDFR in order to park the excess liquidity CBSL also has two options available to restrict access to liquidity window, First Capital Research said.

Option 01: Limiting the frequency of access to the SDFR liquidity window

Option 02: Limiting the amount that can be parked through the Liquidity window

https://www.lankabusinessonline.com/fallout-from-pandemic-prompts-an-unprecedented-rate-cut-fcr/

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

- Post n°474

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Emerging signs of a revival – Biz confidence picks up with corporates planning to get back to doing business

Hot on the heels of a scathing review of the country’s monetary policy by President Gotabaya Rajapaksa on 16 June, in response to the COVID-19 crisis, the Central Bank of Sri Lanka announced a further reduction of the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of licensed commercial banks (LCBs).

This lowering of the SRR by 200 basis points (that’s a total of 300 basis points so far this year) to two percent is expected to inject Rs. 115 billion of additional liquidity to the domestic money market, “enabling the financial system to expedite credit flows to the economy while reducing the cost of funds of LCBs,” according to a statement issued by the Central Bank later that night.

Meanwhile, the latest LMD-Nielsen Business Confidence Index (BCI) paints a more optimistic picture than witnessed previously this year.

THE INDEX The BCI has begun to pick up for the first time in 2020, rising by seven basis points from the previous month to 96 in June. This also marks an improvement compared to where it stood a year ago (81) when the nation was reeling from the 4/21 attacks although the index is still 21 points shy of its average for the last 12 months.

According to Nielsen’s Director – Consumer Insights Therica Miyanadeniya, “optimism is on the rise once again and sentiment is positive as the country has opened up ahead of others in the region. The civilian population, businesses, and private and public enterprises are adjusting to a post-COVID life with many stringent measures put in place to curb a second wave of the pandemic.”

She adds: “Following more than three gruelling months of lockdown, life is gradually adjusting to a ‘new normal’; and companies, businesses and enterprises are picking up from where they left off to salvage what they can over the next half of the year.”

Moreover, she notes that “the resilience of the Sri Lankan people and businesses – who have weathered far more in the past amid a near 30 year civil war and more recently, the Easter Sunday bombings – is evident as they start to rise up like a phoenix from the ashes.”

SENSITIVITIES The impact of the coronavirus continues to feature prominently among the most pressing issues for business today with the value of the rupee and inflation also warranting mentions by survey respondents – but to a far lesser extent than COVID-19. Financial instability is another emerging issue that’s highlighted.

According to those consulted by the pollsters, COVID-19 is also the most pressing national issue at this time.

PROJECTIONS As life appears to be gradually gaining a semblance of normalcy, and businesses begin to adjust to regaining fully operational status, we’re inclined to believe that the BCI may continue on an upward trajectory.

Furthermore, with the general election scheduled for 5 August and the prospect of an end to the political stalemate of recent months, we may continue to witness an uptrend in business confidence.

The other side of the coin is whether or not the anticipated business turnaround will eventuate – and crucially, how soon. That’s anyone’s guess.

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

- Post n°475

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT – Sri Lanka’s Securities and Exchange Commission said it had approved changing listing rules to allow start ups and small firms to raise capital and also make it easier to tap in to a mult-currency board.

Moving away from profit requirement, Sri Lanka would allow firms with revenues and strong cashflows to be considered for listing.

“These eligibility criteria will facilitate companies who do not have a large asset base but have substantial revenue and cash flows (such as companies in the IT sector) to consider the capital market for their funding requirements,” the SEC said.

Tech start ups are risky and usually get first round funding from private equity.

More flexibility would also be given for approved entities to choose the launch date.

The key changes and policy approvals are given below:

The SEC granted approval in terms of Section 24 of the SEC Act No.36 of 1987 (as amended) to the following:

I. Listing of Shares and Debentures

a. At present, the eligibility requirements for obtaining a listing are based on stated capital, net profit and positive net assets. The SEC approved the expansion of the current eligibility criteria by allowing applicant entities to satisfy any one of the following tests:

• Method I: Profit and Net Assets test

• Method II: Revenue and market capitalization test

• Method III: Positive operating Cash Flow and Market capitalization test

These eligibility criteria will facilitate companies who do not have a large asset base but have substantial revenue and cash flows (such as companies in the IT sector) to consider the capital market for their funding requirements.

b. Provide flexibility to the issuer to decide on the allotment basis when the value of an Initial Public Offering (IPO) is more than Rs. 3 Billion subject to CSE agreeing to the proposed allotment basis.

c. Reduce the timeframe for an applicant entity to refund payments due on fully/partly rejected IPO applications and credit investors’ Central Depository System (CDS) accounts with the securities allotted to improve efficiency.

d. Extend the timeframe to open the Subscription List for an IPO from existing requirement to allow the applicant to select the most opportune time to proceed

II. Introduced new Listing Rules on amalgamation to improve regulatory efficiency.

The SEC granted approval to the following initiatives in principle.

• Policy revision to consider removal or relaxation of the present Listing Rule, which imposes a restriction on total value of other class of shares that can be issued to accommodate the interest of certain investors who prefer other class of shares outside ordinary voting shares.

• Extend the Multi Currency Board (MCB) facilities to local companies intending to list Debt in foreign MCB to allow more avenues to raise capital via CSE.

• Other requirements applicable to overseas companies to be listed on the MCB specifically applicable to selected overseas jurisdictions.

• Extend timelines in relation to Enforcement Rules on the Empower Board and permit companies affiliated to external audit firms of the applicant entity to act as sponsors subject to meeting criteria.

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?