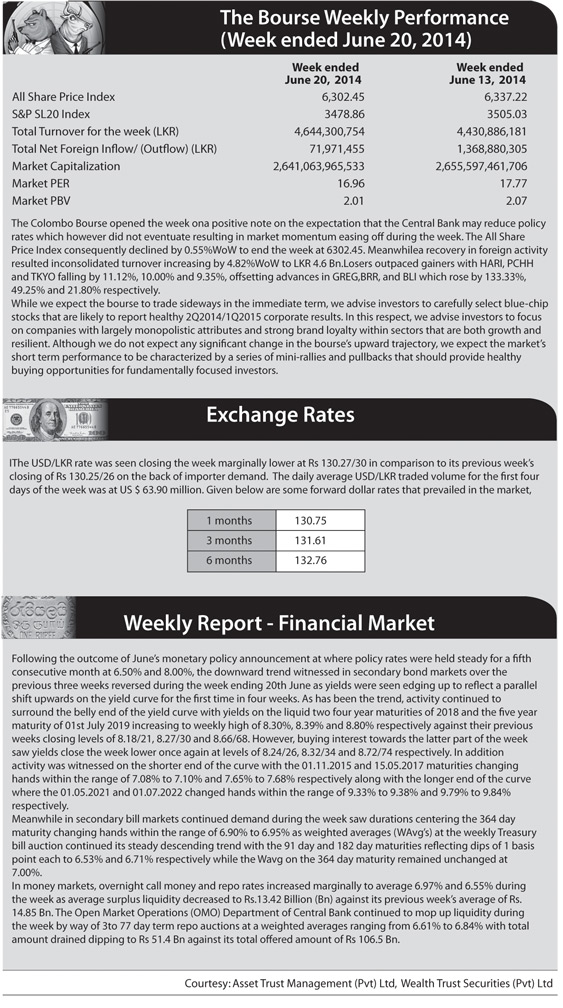

The Bourse Weekly Performance (Week ended June 20, 2014)

The Bourse Weekly Performance (Week ended June 20, 2014)

http://www.sundayobserver.lk/2014/06/22/fin34.asp

LSL Weekly Market Review

LSL Weekly Market Review

On Tuesday Colombo Stock market managed to record marginal returns in both indices where benchmark index gained 0.31 points to close at 6,344.41. 20 Scrip S&P SL index grew by 0.40 points (+0.40%) to end at 3,521.07. Daily market turnover was LKR 1.1bn. Hayleys MGT topped the turnover list with LKR 388mn followed by John Keells Holdings (LKR 84mn) and Commercial Bank (LKR 75mn). Moreover, Lanka IOC, Laxapana Batteries and Hayleys MGT attracted heavy investor interest during the trading session. Foreign investors were net buyers with net inflow of LKR 56mn worth of equities. Foreign participation was 25%.

Colombo equities failed to sustain the three day winning streak on Wednesday as both indices closed with negative returns. All Share Price index lost 26.80 points or 0.42% to end at 6,317.61 while S&P SL 20 index lost 21.58 points or 0.61% to end at 3,499.49. Daily market turnover reached LKR 714mn level underpinned by several negotiated deals recorded in Kelani Tyres, Serendib Hotels, Commercial Bank and Ceylinco Insurance. Kelani Tyre (LKR 148) positioned top at the turnover list followed by Serendib Hotels (LKR 65) and Commercial Bank (LKR 65). Bansei Royal Resorts, John Keells Holdings warrant 0022 and ACME printing were among mostly traded stocks. Foreign investors were net sellers after 13 consecutive days of inflows. Net foreign outflow was LKR 41mn and foreign participation was 25%. Meanwhile at the weekly primary T-bill auction, yield on 3 month and 6 month treasury bills dropped by 1bp to 6.53% and 6.71% respectively while 12 month Treasury bill yield remained unchanged at 7.00%.

On Thursday Colombo equity market witnessed negative returns for the second consecutive day. ASI marginally declined by 4.41 index points or 0.07% to end at 6,313.20 while 20 scrip S&P SL index declined by 8.82 index points or 0.25% to close at 3,490.67. Daily market turnover was LKR 684mn. John Keells Holdings emerged as the top contributor for turnover with LKR 180mn followed by Commercial Bank (LKR 151mn) & John Keells Holdings warrant 0023 (LKR 44mn). Moreover, John Keells Holdings, The Finance non-voting and John Keells Holdings warrant 0023 attracted heavy investor preference during the session. Foreign investors were net buyers with net inflow of LKR 105mn worth equities. Foreign participation was 29%.

Colombo shares extended the losses for the third consecutive day to conclude the weekly operations in negative territory. Benchmark index dropped by 10.75 points (-0.17%) to end at 6,302.45 and S&P SL 20 index dropped 11.81 points (-0.34%) to end at 3,478.86. Price declines in counters such as Sri Lanka Telecom (closed at LKR 46.10, -3.8%), Asian Hotels & Properties (closed at LKR 67.00, -5.6%) and Commercial Bank (closed at LKR 133.00, -1.5%) contributed adversely to the index performance.

Daily market turnover was LKR 1.2bn. Several crossings were recorded in Amana Takaful (90mn shares at LKR 2.00 per share), Kelani Tyres (2.3mn shares LKR 63.00 per share), Commercial Bank (0.9mn shares at LKR 133.50-134.50), Vallibel One (4mn shares at LKR 21.10 per share) and Lanka Walltiles (0.5mn shares at LKR 75.00 per share). Total crossings accounted for 47% of the market turnover. John Keells Holdings (LKR 268mn) topped the turnover list followed by Amana Takaful (LKR 188mn) and Kelani Tyres (LKR 157mn). Market volume recorded a 6 week high of 133mn.

Gainers surpass losers 119 to 81, while 65 counters remained unchanged. Cash map declined to 41% from 56%.

Meanwhile, Ceylon Leather Products Warrant0014, John Keells Holdings and Environmental Resources Warrant0006 attracted heavy investor interest during the day. Further Vallibel Finance declared a first & final dividend of LKR 1.00 per share (DY 3%) during the day.

Foreign investors were net sellers with a net foreign outflow of LKR 191mn and foreign participation was 24%. Foreign outflows were seen in Kelani Tyres (LKR 146mn), John Keells Holdings (LKR 65mn) and Vallibel One (LKR 13mn) while foreign inflow was mainly seen in National Development Bank (LKR 10mn).

www.nation.lk/

Home

Home