COCR to acquire TFIL -what are consequences ?

shane101Top contributor

shane101Top contributor

- Posts : 120

Join date : 2014-04-27

COCR to acquire TFIL -what are consequences ?

COCR to acquire TFIL -what are consequences ?

http://www.cse.lk/cmt/uploadAnnounceFiles/3671407152506_1063.pdf

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

COCR made a mandatory offer at Rs 28.

There are very few share left in the market . Must be around 1.4 million.

What happens if minority shareholders does not accept mandatory offer?

I am sure COCR want to delist or absorb TFIL later.

So what can COCR do if some minority doesn;t sell?

One option is to automatically offer COCR shares in exchange to TFIL if they do not except mandatory offer?

First Guy

First Guy- Posts : 2599

Join date : 2014-02-22

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

Will COCR offer a higher price when it goes for a delisting?

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

FG, possible. Also they can suggest share swap ratio. now NAVPS is closer to Rs 15. Wonder why COCR is not buying all available upto Rs 28. There are still shares trading at Rs 27.

Also they may give Rs 1 dividend as usual ( benefit COCR also) soon.

sereneTop contributor

sereneTop contributor

- Posts : 4850

Join date : 2014-02-26

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

The real issue comes with when they try to unite two cultures.

Are these companies cultures are similar.

Also the attitude of Employees and management.

windi5

windi5- Posts : 31

Join date : 2014-09-01

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

smallvilleTop contributor

smallvilleTop contributor

- Posts : 1872

Join date : 2014-02-23

Location : Trying to figure out..

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

slstock wrote:Anyone who has experience in a case like this?

COCR made a mandatory offer at Rs 28.

There are very few share left in the market . Must be around 1.4 million.

What happens if minority shareholders does not accept mandatory offer?

I am sure COCR want to delist or absorb TFIL later.

So what can COCR do if some minority doesn;t sell?

One option is to automatically offer COCR shares in exchange to TFIL if they do not except mandatory offer?

I think its similar to what happened to SMLL after the merger with PLC.

One of my uncles were given 2 or 3 PLC shares for 1 SMLL.

First Guy

First Guy- Posts : 2599

Join date : 2014-02-22

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

smallville wrote:slstock wrote:Anyone who has experience in a case like this?

COCR made a mandatory offer at Rs 28.

There are very few share left in the market . Must be around 1.4 million.

What happens if minority shareholders does not accept mandatory offer?

I am sure COCR want to delist or absorb TFIL later.

So what can COCR do if some minority doesn;t sell?

One option is to automatically offer COCR shares in exchange to TFIL if they do not except mandatory offer?

I think its similar to what happened to SMLL after the merger with PLC.

One of my uncles were given 2 or 3 PLC shares for 1 SMLL.

Yes it was 1 PLC for 3 SMLL shares if I remember correctly.

At that time, this was a good deal for SMLL holders.

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

Btw, in the SMLL/PLC case does anyone know any paper work was sent to sign or it was automatic share swap after the X date?

But I also think, it should be applied to TFIL/COCR case.

I sold 2/3 of my TFIL so far. Want to know if there will be paper work involved if I hold till merger I want to avoid such as it will be hassle for me since am not in SL nowadays.

If anyone has contacts with TFIL/COCR can one please check what happens after Offer ends ?

First Guy wrote:smallville wrote:slstock wrote:Anyone who has experience in a case like this?

COCR made a mandatory offer at Rs 28.

There are very few share left in the market . Must be around 1.4 million.

What happens if minority shareholders does not accept mandatory offer?

I am sure COCR want to delist or absorb TFIL later.

So what can COCR do if some minority doesn;t sell?

One option is to automatically offer COCR shares in exchange to TFIL if they do not except mandatory offer?

I think its similar to what happened to SMLL after the merger with PLC.

One of my uncles were given 2 or 3 PLC shares for 1 SMLL.

Yes it was 1 PLC for 3 SMLL shares if I remember correctly.

At that time, this was a good deal for SMLL holders.

pathfinderTop contributor

pathfinderTop contributor

- Posts : 1450

Join date : 2014-02-23

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

First Guy wrote:

Yes it was 1 PLC for 3 SMLL shares if I remember correctly.

It was otherway round.

smallvilleTop contributor

smallvilleTop contributor

- Posts : 1872

Join date : 2014-02-23

Location : Trying to figure out..

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

pathfinder wrote:First Guy wrote:

Yes it was 1 PLC for 3 SMLL shares if I remember correctly.

It was otherway round.

Ahh just noticed the mistake

girihell

girihell- Posts : 131

Join date : 2014-03-03

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

girihell

girihell- Posts : 131

Join date : 2014-03-03

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

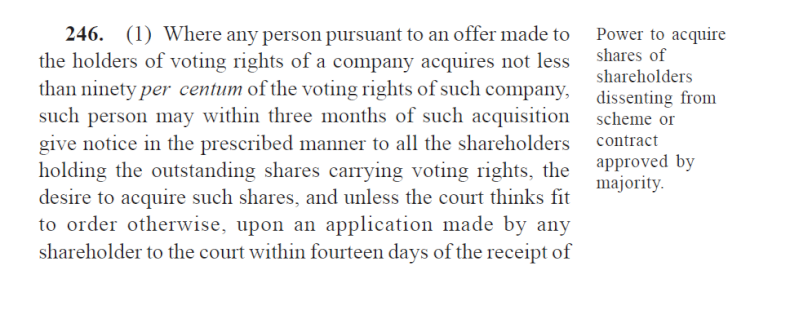

so according to this letter they (COCR) can forcefully buy remaining shares at Rs:28 although they are trading above Rs 40?

or am I getting the wrong message

could somebody with better knowledge explain this?

section of the companies act

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

This is certainly 3rd class behavior by COCR and by their secretary Jacey ( to word it such) and to release such to panic and force small shareholders to give up a share that is trading at Rs 40 to buy cheap at rs 28. I lost respect for COCR . Is this how a company wanting to go higher behaves ? By intimidating share holders? Under what law can you send out a document like this after a madantory offer is finished and when some shareholder did not want to sell? IF you wish you can send another volunteer offer at a much higher price, after re-valuating the share . Look at how decent DFCC, NDB, JKH, CFIN , COMB are. Look at how PLC did it with SMLL.

1) To the best of my knowledge , No company has to right to take over shares like that under the law. If they can, TAP should have taken over GREG by now. CARS should have taken over GOOD by now. They can offer but holders can agree or deny. If they deny they cannot get it by force. That exactly what happened even after they extended the mandatory offer for TFIL. There are people who did not want to sell TFIL at 28. Then TFIL prices shot up for a reason.

Now am starting to think , whether when TFIL had reported higher earnings in Sept , the massive tax deduction they showed was to show lower PAT had some connection to panic public to sell their shares cheaply.

2) Notice this is to take over the shares. If they are taking about Delisting or merging they have the option of offering COCR shares in exchange for TFIL. That is permitted by law from what I know ( this is their later intent I am sure and I hinted this in another topic) .

3) Here what is happening is TFIL is still an independent company and without any public disclosure of intent to delist or merge, by brute force majority shareholder COCR is trying to play with minds of small shareholder to intimidate to give up their shares at Rs 28 when they are trading at Rs 40 in the market .

4)If someone thinks delisting is so easy , look at how SHAL,GOOD , LAMB is struggling to delist for such a long time. Atleast their parents are decent law abiding companies who are respecting the law and obtaining whatever available shares in the open market as they know they cannot delist without obtaining all the shares legally or by offering a share swap after considering market values. How much time and effort did KURU and CDIC take. KURU offered to buy the share at nearly 50% more market price when they were making lot of losses for years. COCR is wanting to buy TFIL at 30% below market price for a company that is one of the best in small finance at CSE. Why should anyone sell?

So in summary, if COCR management is decent and are concerned about minority share holder rights :

1) They should withdraw this document, and re-word it to make it as a request only

(if anyone is crazy to sell it at Rs 28 now when COCR is at Rs 46).

2) Fire this Secretary Jacey and Company who does not respect rights of minority share holders and can get you into a legal mess if small holders files a case for intimidation and abuse.

3) There are only less than 1 million shares of TFIL in the market. If you want to delist , why not say so and do a honorable offer for w sahr swap of COCR to TFIL for pities sake without all this brute level behavior to panic and buy cheaper at Rs 28. SEC should watch this.

How easy is it to be open to tell they want to delist later, offer less than 1 million shares of COCR ( which is nothing ) for TFIL in exchange , make both shareholders and company happy without using these unnecessary tactics ?

If COCR is valued at Rs 46 now why is TFIL valued at Rs 28 with around same net assets . When TFIL wasoffered Rs 28 COCR was in early 20s.

Excuse me COCR , don't make mess for yourself just when I started to beleive in yoru company. You cannot afford getting bad publicity when there other contenders comign up.

If a handful of share holders gets intimidated over his and share prices falls for TFIL that is manipulation ( of a fundamentally valued share that will have Rs 3 eps and NAV of about 15) . SEC should take note. Fun is if the present "strong" share holders take TFIL price higher than COCR .

sereneTop contributor

sereneTop contributor

- Posts : 4850

Join date : 2014-02-26

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

On top that they Called they their shelves as

" Manudam Pirunu Mulya Samagama" .. Pathetic.

WARREN BSL

WARREN BSL- Posts : 114

Join date : 2014-07-19

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

stocks hunterTop contributor

stocks hunterTop contributor

- Posts : 1280

Join date : 2014-03-16

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

Now GREG and the TFIL are two different scenarios.In the banking sector they are going to scale down the companies. In a situation like that they have to do it.

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

To start and add further light, let us consider CDIC case where NDB wanted to delist CDIC.

They did a share buy back , at Rs 545 in 2013

When they intended to delist, they made public announcement and offered Rs 600 ( which was much more beneficial to share holders ) than the market traded price of Rs 499.9 then. So ofcourse CDIC minority benefits by accepting it. why shouldn't they.

In this case let look at TFIL case.

1) TFIL was independant company operating and listed under CSE. COCR wanted to merge or absorb TFIL according to CB merger/acquisition directives before delisting. unlike CDIC (which is now going to be Limited company).

To do this their offers needs to be even more attractive to what CDIC or KURU did for delisting is it not? People what do you think?

2) Let study TFIL history

a) For TFIL they gave a mandatory offer at Rs 28

b) at that time COCR was trading in early rs 20s mind you( less than TFIL)

c) Then they jacked up COCR to beyond TFIL value.

( both are having similar Net asset values. COCR eps maybe a bit more though)

d) Then they offered an extended mandatory offer at RS 28 for TFIL while making

COCR prices even going up higher to over Rs 40s.

e) At the end of extended mandatory offer at Rs 28 for TFIL, naturally there were people who did not want to sell at a low Rs 28

( note these shares are listed at CDS also , not just anywhere)

f) Then TFIL shot up to meet COCR values in Rs 40s for obvious reasons

Now what COCR is trying to do,

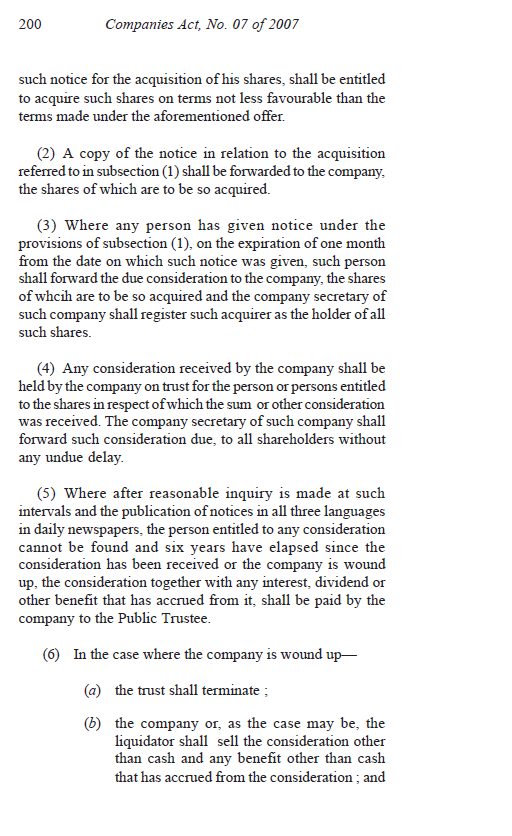

1) From what I see is COCR is trying to misquote the Companies act to their benefit, offer lower prices than trading at market ( Rs 40) for TFIL to scare minority to buy them at Rs 28 which they could not get at a mandatory offer.

Here is another instance of the mis use. What if COCR got less than 90% of TFIL. They will not be in a position to even quote the Sec 246.

Now because they got thew power , they say lets abuse it.

2) Note Companies act Sec 246

a) falls under section for amalgamation of companies. Where is the disclosure for such?

b) says " notice in the prescribed manner to all the shareholders

holding the outstanding shares carrying voting rights, the desire to acquire such shares"

It means to request outstanding share holders they would like to but not to forcefully to take over their CDS listed shares at below market prices!

Clearly this is a clear abuse and violates minority share holder rights. This is purely unfair for all minority share holders.

If this is allowed, any company who has more than 90% shares ( like CDIC , KURU, SHAL, GOOD ) etc can forcefully prescribe an offer and take over all share of the minority at below market prices!!!! There won't be any need for SEC or small time investors.

I think some shareholder of TFIL in Sri Lanka ( also Mr Vignarajah time to fight ) should file a complaint at the court soon as possible to stop this abuse. Else this will be trend and so bad for CSE.

SEC should interpret what COCR is trying to do here and the safeguard the minority shareholders. It is their duty.

Also can someone in the legal sector please read and interpret Sec 246. It will be public service.

girihell

girihell- Posts : 131

Join date : 2014-03-03

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

as serene said they aren't look like going with their tag line

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

Sec 246 1 side note says ( apart from all the things I highlighted)

"Power to acquire shares of shareholders dissenting from scheme or contract approved by

majority" .

Tell me

a) what is the contract or scheme approved by the majority here for TFIL?

b) are Board of directors of COCR the majority. God bless CSE if so.

TFIL minority who got the letter and any person who want to see CSE a fair place should voice their opinion and make SEC notice on monday itself. COCR is trying to manipulate TFIL market prices by making it crash to their benefit while abusing minority TFIL holders to get it at Rs 28.

Remember how SEC stepped in to PCHH deal.

girihell

girihell- Posts : 131

Join date : 2014-03-03

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

and making the general public aware of the real facts Thanks again!!!

Illusion

Illusion- Posts : 78

Join date : 2014-02-28

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

The AlchemistTop contributor

The AlchemistTop contributor

- Posts : 651

Join date : 2014-02-25

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

Just some points that come to mind.

1. When COCR bought out The Cooray Family interest in TFIL @ Rs 28, over 96 %, they established the price at Rs 28/ = for any future mandatory offer de-listing price. So simply and just because the price re-rated afterwards to the 40's should not make them liable to pay that incremental price.

2. Since we have no idea whether of future plans of COCR re TFIL i.e. leave it as a standalone company (subsidiary) or merge with it, we cannot expect them to for eg give TFIL shareholders COCR shares.

3. Since there is a new mandatory free float law of 20 % and since post acquisition, it does not comply with it, and COCR may have no desire to increase Free-float of TIFL to seek compliance, then a mandatory de-listing maybe the eventual option.

4. Prior to delisting, Since the New Companies Act seems to offer COCR a remedy to forcibly buy-over remaining shares at mandatory offer price ??? IF none of the remaining shareholders objects within 2 weeks (remedy is provided), they could do so however unethical it seems.

5. Perhaps the reason why COCR does not want to straightaway delist is because there maybe some clauses about a weighted average market prices etc in preceding 3 month prior (higher than Rs 28) but i doubt it since over 95 % was acquired at Rs 28. (or maybe even an independent valuation).

6. The remedy is prescribed in the company's Act to seek relief from court within a two week period. but who except for Mr. Vignarajah will incur costs and do it ?

7. Furthermore, besides the ethical issues, is it really worth it ? based on TIFL fundamentals (and if the majority Cooray Family saw fit to sell controlling stake at Rs 28), who can argue with that. Furthermore, if anyone feels TFIL is undervalued at Rs 28/-, they have the option of buying COCR, although i have not studied the valuations post acquisition.

8. In Principle, their should be an option to remain as a shareholder of TFIL although it is mandatorily de-listed. (i know many people who are still shareholders for eg of Walker Tours even after JKH gave share swap for KHL and delisted Walker Tours).

stocks hunterTop contributor

stocks hunterTop contributor

- Posts : 1280

Join date : 2014-03-16

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

Now COCR offered a very fair price to TFIL. Rs28 seems to be a fair price and nobody at that time protested against that.More than 96% they acquired at that price. What has happened here is due to low liquidity in the mkt TFIL share is now trading at Rs40 levels where COCR has nothing to do it. COCR clearly mentioned their buying price and promoters took this to present price levels due to low liquidity. Same thing has happened to NIFL & other few non banking counters which is not correct. This is clear manipulation.So my argument is also the max price COCR can give to TIFL share holders is Rs28. If not it is not fair by the 96% of the TIFL share holders who subscribe to the offer at Rs28.

This is purely my idea only.

stocks hunterTop contributor

stocks hunterTop contributor

- Posts : 1280

Join date : 2014-03-16

Re: COCR to acquire TFIL -what are consequences ?

Re: COCR to acquire TFIL -what are consequences ?

slstock wrote:Now what COCR is trying to do,

1) From what I see is COCR is trying to misquote the Companies act to their benefit, offer lower prices than trading at market ( Rs 40) for TFIL to scare minority to buy them at Rs 28 which they could not get at a mandatory offer.

I'm not agreeing to this. To my simple knowledge when COCR published the offer price the trading price of TFIL was around Rs23 - Rs25. If this was @Rs40 levels at that time it is not ethical as sls said. But here nothing has happened like that.

" />

" />Manipulators are the main culprits here.

Again this is my idea only. I may be wrong/correct. Time will tell everything.

Home

Home